Question:

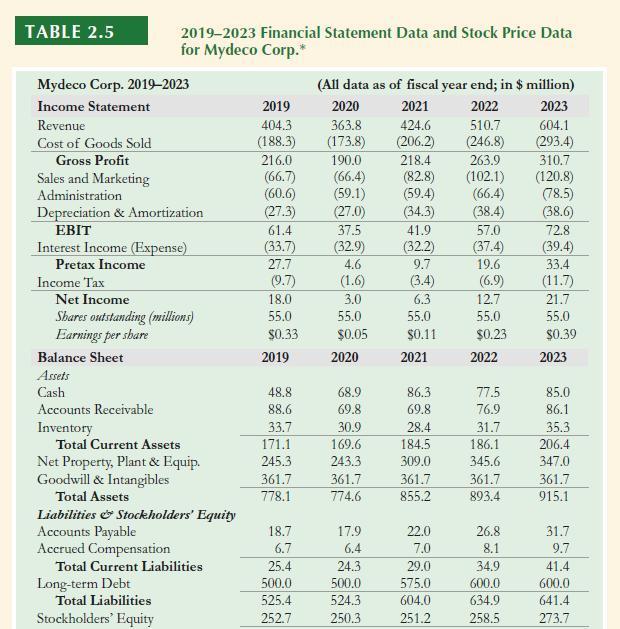

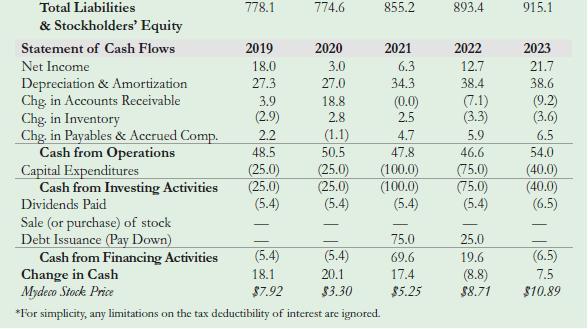

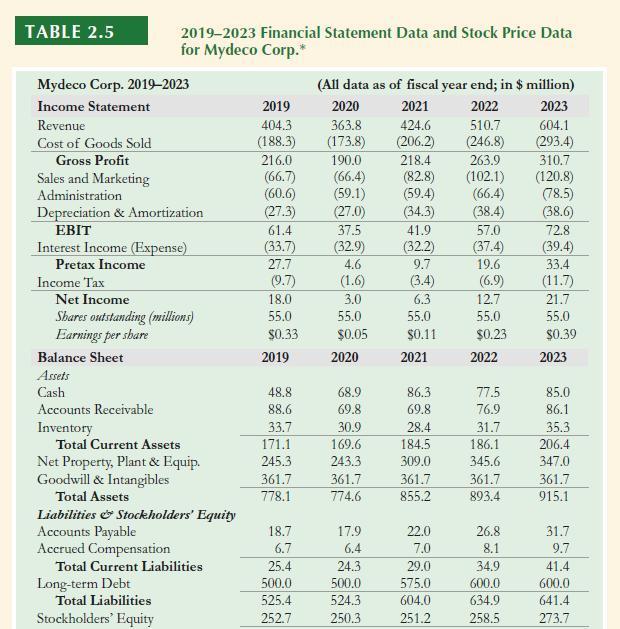

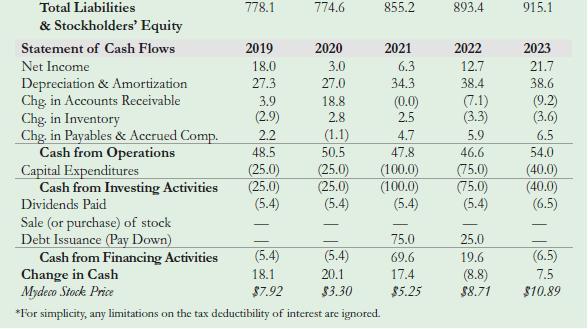

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp.

a. How did Mydeco’s book debt-equity ratio change from 2019 to 2023?

b. How did Mydeco’s market debt-equity ratio change from 2019 to 2023?

c. Compute Mydeco’s debt-to-enterprise value ratio to assess how the fraction of its business that is debt financed has changed over the period.

Transcribed Image Text:

TABLE 2.5 2019-2023 Financial Statement Data and Stock Price Data for Mydeco Corp.* (All data as of fiscal year end; in $ million) Mydeco Corp. 2019-2023 Income Statement 2019 2020 2021 2022 2023 Revenue 404.3 363.8 424.6 510.7 604.1 Cost of Goods Sold (188.3) (173.8) (206.2) (246.8) (293.4) Gross Profit 216.0 190.0 218.4 263.9 310.7 Sales and Marketing (66.7) (66.4) (82.8) (102.1) (120.8) Administration (60.6) (59.1) (59.4) (66.4) (78.5) Depreciation & Amortization (27.3) (27.0) (34.3) (38.4) (38.6) EBIT 61.4 37.5 41.9 57.0 72.8 Interest Income (Expense) (33.7) (32.9) (32.2) (37.4) (39.4) Pretax Income 27.7 4.6 9.7 19.6 33.4 Income Tax (9.7) (1.6) (3.4) (6.9) (11.7) Net Income 18.0 3.0 6.3 12.7 21.7 Shares outstanding (millions) 55.0 55.0 55.0 55.0 55.0 Earnings per share $0.33 $0.05 $0.11 $0.23 $0.39 Balance Sheet 2019 2020 2021 2022 2023 Assets Cash 48.8 68.9 86.3 77.5 85.0 Accounts Receivable 88.6 69.8 69.8 76.9 86.1 Inventory 33.7 30.9 28.4 31.7 35.3 Total Current Assets 171.1 169.6 184.5 186.1 206.4 Net Property, Plant & Equip. 245.3 243.3 309.0 345.6 347.0 Goodwill & Intangibles 361.7 361.7 361.7 361.7 361.7 Total Assets 778.1 774.6 855.2 893.4 915.1 Liabilities & Stockholders' Equity Accounts Payable 18.7 17.9 22.0 26.8 31.7 Accrued Compensation 6.7 6.4 7.0 8.1 9.7 Total Current Liabilities 25.4 24.3 29.0 34.9 41.4 Long-term Debt 500.0 500.0 575.0 600.0 600.0 Total Liabilities 525.4 524.3 604.0 634.9 641.4 Stockholders' Equity 252.7 250.3 251.2 258.5 273.7