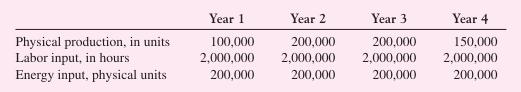

Sony International has an investment opportunity to produce a new stereo color TV. The required investment on

Question:

Sony International has an investment opportunity to produce a new stereo color TV. The required investment on January 1 of this year is \($32\) million. The firm will depreciate the investment to zero using the straight-line method. The firm is in the 34-percent tax bracket.

The price of the product on January 1 will be \($400\) per unit. That price will stay constant in real terms. Labor costs will be \($15\) per hour on January 1. They will increase at 2 percent per year in real terms. Energy costs will be \($5\) per physical unit on January 1; they will increase at 3 percent per year in real terms. The inflation rate is 5 percent. Revenues are received and costs are paid at year-end.

The riskless nominal discount rate is 4 percent. The real discount rate for costs and revenues is 8 percent. Calculate the NPV of this project.

Step by Step Answer: