The Executive Committee of Advanced Technology (AT) Robert Smith, President; Linda Humphrey, Vice President of Finance;

Question:

The Executive Committee of Advanced Technology (AT) – Robert Smith, President; Linda Humphrey, Vice President of Finance; Sam Miller, Vice President of Marketing; and Susan Crum, Vice President of Production – scheduled a luncheon meeting on September 1, 1996, to discuss two major problems for the welfare of the company: (1) how to finance the rapid expansion of its production facilities and (2) how to cope with a growing competition in its major overseas markets. In addition, the Department of Justice requested AT to answer several questions about bribes, gifts, slush funds, and grease payments in relation to its foreign sales.

This inquiry began in response to a 100-page complaint by its overseas competitor, which alleged that AT had violated the Foreign Corrupt Practices Act of 1977.

AT has recently enjoyed a rapid growth in business. The company is anticipating substantial increases in sales for the next few years. However, it must solve two major problems –

capacity and strong competition in foreign operations – if it is to maintain fast sales growth for years to come.

AT produces office automation systems and equipment. In addition to introducing a newly designed mainframe computer, the company has aggressively increased research in minicomputers and word processors. These products are in high growth markets, and the firm’s expenditures for these projects have more than proved their worth. In fact, the company’s major problem has been to increase production fast enough to meet demand of its Asian customers. The company’s capacity has expanded steadily since 1980, but it has often lost sales because of insufficient production.

The industry recognizes AT as one of the fastest growing companies in the market. Experts in the high-tech industry have projected for the next 10 years a potential bonanza for minicomputers and word processors. Thus, the company plans to invest heavily in research and development for the next 5 years. It also plans to increase production quickly by acquiring existing computer manufacturing firms and by establishing new production facilities.

has five manufacturing locations in the USA and three abroad, with offices in 13 countries. In 1995, approximately 40 percent of its sales came from foreign operations – primarily South America and Asia, where the company has recently faced stiff competition from its larger rivals, such as IBM, Digital Equipment, and Olivetti. The company has depended on distributors for most of its overseas sales.

Conflict of Interest in Financial Affairs Thomas Nickerson is a Special Assistant to the Vice President of Finance, Linda Humphrey. He graduated from a major university in St. Louis, Missouri, with an MBA in Finance. After 2 years of experience with Ernst & Young, a major CPA firm in St. Louis, he joined the accounting staff and served in a variety of accounting and finance positions for 5 years. Two years ago, he was appointed Special Assistant to Ms Humphrey at an unusually high salary, mainly because of his outstanding financial and communication talents. Thomas Nickerson has a large family and a home with a \($450,000\) mortgage. His deep debt and huge financial needs hardly matter to him, because he has a promising future at the company.

Ms Humphrey approached Thomas with a special task on August 1, 1996. She informed him that she had met with other vice presidents and decided to purchase Computer Engineering to alleviate the capacity problem. She further stated that the acquisition would be highly advantageous for AT, but she needed to convince two members of the board of directors.

Then she instructed him to prepare a report justifying the acquisition of the company.

Under the terms, AT would offer Computer Engineering two million shares of its stock. The market price of the stock was \($20\) per share.

Normally, Thomas would have welcomed the assignment, but this one made him uneasy.

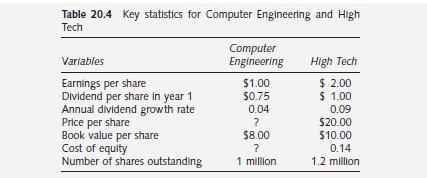

Computer Engineering’s financial statements indicated poor performance as compared with comparable companies in the field. He knew that Ms Humphrey and other vice presidents had helped the current top executives of Computer Engineering set up their company. He suspected that vice presidents of AT owned sizable blocks of Computer Engineering stock, which was not publicly traded. To establish a fair market price for Computer Engineering, he compiled the statistics presented in table 20.4. High Tech is more similar to Computer Engineering than any other company whose stock is traded in the public market.

Ethics Versus Profits in Global Business The Foreign Corrupt Practices Act of 1977 (FCPA) has encouraged US companies to introduce policies against corrupt foreign payments and to improve internal controls. The FCPA bans illegal payments to foreign officials, monitors accounting procedures, and levies heavy penalties for violations. The FCPA forced AT to think about its way of doing business overseas. The company had expanded its foreign operations very quickly. In the 1960s, less than 2 percent of its sales came from foreign operations, but by the late 1970s its foreign operations accounted for 30 percent of total sales.

Just like many other companies, AT had undertaken positive steps to prevent illegal payments to foreign officials and to improve internal control. In 1980, the company published its

first corporate code, along with two separate area codes: one for the USA and another one for the foreign area. The code of business conduct for overseas employees reflected most provisions of the FCPA, so that the company would not have any trouble with the law.

Marketing Vice President Miller had been under heavy pressure from President Smith to increase the company’s foreign sales by 30 percent per year for the next 5 years. Mr Miller thought that when in Rome, some do as the Romans do. In other words, he did not hesitate to call the FCPA “bad business” and “unnecessary.” Miller felt that the FCPA should be repealed for several reasons. First, it forced US companies to increase audit costs substantially.

Second, the Department of Justice and the SEC failed to establish clear guidelines. Third, it put US companies at a competitive disadvantage. Fourth, in many countries, foreign payments are not outlawed, but they are encouraged. Fifth, the FCPA was unnecessary because US law enforcement agencies already had many statutes to prevent illegal foreign payments by US companies.

Mr Miller reflected on the report he would present to the Executive Committee. The purpose of this report was to make certain that AT was complying with its corporate code of conduct.

There was, however, one situation that required a tough decision. This particular situation was considered an acceptable practice in the countries where they occurred, but he did not know how he would handle specific questions if they should come up.

Kevin Hart was the exclusive distributor for Advanced Technology products in South American countries. He had a reputation for reliability and efficiency. However, the most recent audit suggested that he had corruptly influenced customs officials to obtain lower duty rates for AT’s products. In doing so, he had violated both the FCPA and the company’s code of conduct.

AT had asked Kevin to agree in writing to abide by the code, but he had refused to do so.

He had argued that these “grease payments” were customary in these countries. He had insisted that he could not compete effectively without them. Kevin had represented AT for many years and generated approximately \($10\) million worth of business per year for the company. His exclusive dealership contract would be up for renewal in a few months. AT had suggested that it might refuse to renew its contract unless he agreed to abide by the code. Mr Miller knew that it would be difficult to resolve this problem while he was under heavy pressure to increase the company’s overseas sales by 30 percent per year.

Case Questions 1 Use the data in table 20.4 to estimate the market value of Computer Engineering in the following three ways: (1) price–earnings ratio, (2) market value/book value, and (3) the dividend growth model.

2 List and discuss the options available to Thomas Nickerson.

3 Discuss the two major sections of the FCPA – antibribery and accounting.

4 List and discuss the pros and cons concerning corporate codes of conduct.

5 If you were Sam Miller, what would you do about the situation in these South American countries?

6 The Internet Center for Corruption Research provides the transparency international perceptions index and a comprehensive assessment of countries’ integrity performance. Use the website of this organization, www.gwdg.de/~uwvw/icr.htm, to identify the five most corrupt countries and the five least corrupt countries.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim