The scene: John and Marsha hold hands in a cozy French restaurant in downtown Manhattan, several years

Question:

The scene: John and Marsha hold hands in a cozy French restaurant in downtown Manhattan, several years before the mini-case in Chapter 9. Marsha is a futures-market trader. John manages a $250 million common-stock portfolio for a large pension fund. They have just ordered tournedos financiere for the main course and flan financiere for dessert. John reads the financial pages of The Wall Street Journal by candlelight.

John: Wow! Potato futures hit their daily limit. Let?s add an order of gratin dauphinoise. Did you manage to hedge the forward interest rate on that euro loan?Marsha: John, please fold up that paper. (He does so reluctantly.) John, I love you. Will you marry me?John: Oh, Marsha, I love you too, but . . . there?s something you must know about me?something I?ve never told anyone.Marsha: (concerned) John, what is it?John: I think I?m a closet indexer.Marsha: What? Why?John: My portfolio returns always seem to track the S&P 500 market index. Sometimes I do a little better, occasionally a little worse. But the correlation between my returns and the market returns is over 90%.

Marsha: What?s wrong with that? Your client wants a diversified portfolio of large-cap stocks. Of course your portfolio will follow the market.

John: Why doesn?t my client just buy an index fund? Why is he paying me? Am I really adding value by active management? I try, but I guess I?m just an . . . indexer.

Marsha: Oh, John, I know you?re adding value. You were a star security analyst. John: It?s not easy to find stocks that are truly over- or undervalued. I have firm opinions about a few, of course.

Marsha: You were explaining why Pioneer Gypsum is a good buy. And you?re bullish on Global Mining.

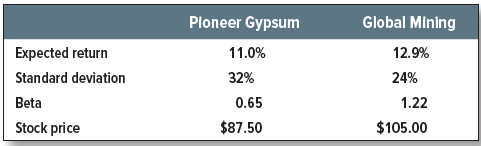

John: Right, Pioneer. (Pulls handwritten notes from his coat pocket.) Stock price $87.50. I estimate the expected return as 11% with an annual standard deviation of 32%. That?s twice the market standard deviation of 16%.

Marsha: Only 11%? You?re forecasting a market return of 12.5%.

John: Yes, I?m using a market risk premium of 7.5% and the risk-free interest rate is about 5%. That gives 12.5%. But Pioneer?s beta is only .65. I was going to buy 30,000 shares this morning, but I lost my nerve. I?ve got to stay diversified.

Marsha: Have you tried modern portfolio theory?John: MPT? Not practical. Looks great in textbooks, where they show efficient frontiers with 5 or 10 stocks. But I choose from hundreds, maybe thousands, of stocks. Where do I get the inputs for 1,000 stocks? That?s a million variances and covariances!

Marsha: Actually only about 500,000, dear. The covariances above the diagonal are the same as the covariances below. But you?re right, most of the estimates would be out-of-date or just garbage.

John: To say nothing about the expected returns. Garbage in, garbage out.

Marsha: But John, you don?t need to solve for 1,000 portfolio weights. You only need a handful. Here?s the trick: Take your benchmark, the S&P 500, as security 1. That?s what you would end up with as an indexer. Then consider a few securities you really know something about. Pioneer could be security 2, for example. Global, security 3. And so on. Then you could put your wonderful financial mind to work.

John: I get it: Active management means selling off some of the benchmark portfolio and investing the proceeds in specific stocks like Pioneer. But how do I decide whether Pioneer really improves the portfolio? Even if it does, how much should I buy?

Marsha: Just maximize the Sharpe ratio, dear.

John: I?ve got it! The answer is yes!

Marsha: What?s the question?

John: You asked me to marry you. The answer is yes. Where should we go on our honeymoon?

Marsha: How about Australia? I?d love to visit the Sydney Futures Exchange.

1. Table 8.4 reproduces John?s notes on Pioneer Gypsum and Global Mining. Calculate the expected return, risk premium, and standard deviation of a portfolio invested partly in the market and partly in Pioneer. (You can calculate the necessary inputs from the betas and standard deviations given in the table. Hint: A stock?s beta equals its covariance with the market return divided by the variance of the market return.) Does adding Pioneer to the market benchmark improve the Sharpe ratio? How much should John invest in Pioneer and how much in the market?

2. Repeat the analysis for Global Mining. What should John do in this case? Assume that Global accounts for .75% of the S&P index.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen