The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2015. Each bond

Question:

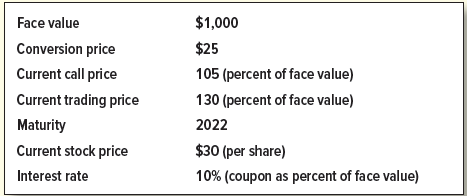

The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2015. Each bond has the following features.

a. What is the bond?s conversion value?

b. Can you explain why the bond is selling above conversion value?

c. Should Surplus call? What will happen if it does so?

Transcribed Image Text:

$1,000 Face value $25 Conversion price Current call price 105 (percent of face value) 130 (percent of face value) Current trading price 2022 Maturity $30 (per share) Current stock price 10% (coupon as percent of face value) Interest rate

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

a Conversion number of shares 1000 25 40 Conversion value 40 X 30 1200 b A conver...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen

Question Posted:

Students also viewed these Business questions

-

Can you explain why diversification lowers risk?

-

Can you explain why adult and child moviegoers are often charged different amounts when going to the movie theater, keeping in mind that both an adult and a child each takes up an entire seat?

-

Can you explain why it is sometimes the case that unemployment rates increase while additional jobs are being created in our economy? And why is it sometimes the case that unemployment rates decrease...

-

What has been the trend in sales over the years presented? July 29, July 30, 2023 2022 (Unaudited) (Unaudited) Net sales $ 5,164,072 100.0% $ 4,643,014 100.0% Cost of sales 3,115,603 60.3% 2,773,824...

-

Answer each probability question. a. List the equally likely outcomes if a coin is tossed twice. b. List the equally likely outcomes if two coins are tossed once. c. Draw a tree diagram that...

-

Convert the points (x, y) = (1, 3), (3, 1) from rectangular to polar coordinates.

-

Describe four barriers to effective listening and apply techniques to improve listening and understanding

-

Multiple Choice Questions 1. James Corporation owns 80 percent of Carl Corporations common stock. During October, Carl sold merchandise to James for $250,000. At December 31, 40 percent of this...

-

The stock price of Rene Co. is $68. Investors require an 11.00% rate of return on similar stocks. If the company plans to pay a dividend of $3.85 next year, what growth rate is expected for the...

-

Here is a list of activity times for a project as well as crashing costs for its activities. Determine which activities should be crashed and the total cost of crashing if the goal is to shorten the...

-

Maple Aircraft has issued a 4% convertible subordinated debenture due 2023. The conversion price is $47.00 and the debenture is callable at 102.75% of face value. The market price of the convertible...

-

Match each of the following terms with one of the definitions below: A. Revolving credit B. Bridge loan C. Term loan D. Syndicated loan E. Commitment fee F. Maintenance covenant a. Requirement that...

-

Draw an indifference curve for a risk-neutral investor providing utility level .05.

-

The following data are available for S&R company7 for its first month of operations: Direct materials Direct labor @P40/hr Job 101 Job 102 Job 103 P60,000 P90,000 P56,000 18,000 36,000 38,000...

-

1 2. Let A(x) = sin t + 1 dt, find A'(x) at x = 0, and 2 3. Evaluate the following definite integrals: 2 (a) (3x + 4x)dx 4 (b) xdx

-

A debt can be repaid with payments of $3912 today, $2436 in 2 years and $6770 in 5 years. What single payment will settle the debt 3 years from now if interest is 10.5% compounded quarterly?

-

With the PID/Freeze Frame/Snapshot data monitor function, input/output signal monitor items set in the start/stop control module can be selected and read out in real-time. Answer the following PID...

-

Which of the four global strategies (International, Multidomestic, Global-Standardization, or Transnational strategy) is 3M using? Is this the best strategy for it to use? Why or why not?

-

Nitric acid is a strong acid but chloric(I) acid, HClO, is a weak acid. a. Explain the difference between a strong and a weak acid. b. Write equations showing the ionisation of each of these acids in...

-

A genetically engineered strain of Escherichia coli (E. coli) is used to synthesize human insulin for people suffering from type I diabetes mellitus. In the following simplified reaction scheme,...

-

Look at some real companies with different types of assets. What operating problems would each encounter in the event of financial distress? How well would the assets keep their value?

-

Here are book and market value balance sheets of the United Frypan Company (UF): Assume that MM's theory holds with taxes. There is no growth, and the $40 of debt is expected to be permanent. Assume...

-

The Bunsen Chemical Company is currently at its target debt ratio of 40%. It is contemplating a $1 million expansion of its existing business. This expansion is expected to produce a cash inflow of...

-

why would an auditor want to complete dual-purpose tests? what procedure can be put into place to help prevent fraud? List 4 procedures.

-

Based on the following information, calculate sustainable growth rate for Groot, Inc.: Profit margin= 7.1% Total asset turnover = 1.90 Total debt ratio = .45 Payout ratio = 20% What is the ROA here?

-

Consider the following: a call option on a stock has strike price $100, premium of $5 and the current price of the underlying stock is $100. If you buy the call option today, what is your holding...

Study smarter with the SolutionInn App