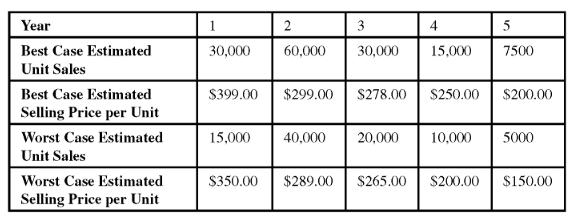

Your company is considering selling a newly developed portable video product, the j View. You have developed

Question:

Your company is considering selling a newly developed portable video product, the j View. You have developed some forecasts for unit sales and selling price per unit, shown below. You also anticipate that selling the new product will require the purchase of \($10\) million in fixed assets, which will be depreciated under the MACRS 5-year class life, and which you anticipate can be sold at the end of the project for \($2,500,000.\) You also anticipate that the required level of NWC will be 20 percent of the following year's sales; that variable costs will run 40 percent of sales; that yearly fixed costs will be \($2\) million; that you will face a 34 percent marginal tax rate, and that sales of the j View will end after year 5. Assume that the appropriate rate of interest for projects such as this is 10 percent.

What will be the NPV of this project under the "Worst Case" assumptions?

a. -\($4,479,605\)

b. -\($2,532,739\)

c. \($2,532,739\)

d. \($4,479,605\)

Step by Step Answer: