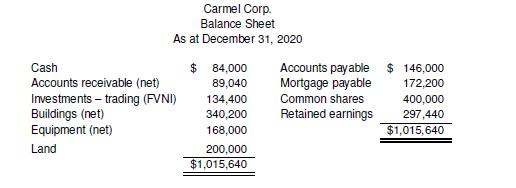

Below is the unclassified balance sheet for Carmel Corp. as at December 31, 2020: The net income

Question:

Below is the unclassified balance sheet for Carmel Corp. as at December 31, 2020:

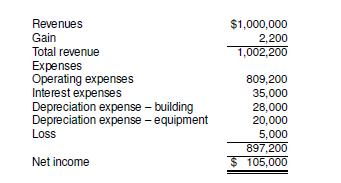

The net income for the year ended December 31, 2021, was broken down as follows:

The following events occurred during 2021:

1. Investments in traded securities are short-term securities and the entire portfolio was sold for cash at a gain of $2,200. No new investments were purchased in 2021.

2. A building with a carrying value of $225,000 was sold for cash at a loss of $5,000.

3. The cash proceeds from the sale of the building were used to purchase additional land for investment purposes.

4. On December 31, 2021, specialized equipment was purchased in exchange for issuing an additional $50,000 in common shares.

5. An additional $20,000 in common shares were issued and sold for cash.

6. Dividends of $8,000 were declared and paid in cash to the shareholders.

7. The cash payments for the mortgage payable during 2021 included principal of $30,000 and interest of $35,000. For 2022, the cash payments will consist of $32,000 for the principal portion and $33,000 for the interest.

8. All sales to customers and purchases from suppliers for operating expenses were on account. During 2021, collections from customers were $980,000 and cash payments to suppliers were $900,000.

9. Ignore income taxes for purposes of simplicity.

Required:

a. Prepare a classified SFP/BS in good form as at December 31, 2021. Identify which required disclosures discussed in Chapter 4 were missed due to lack of information?

b. Prepare a statement of cash flows in good form with all required disclosures for the year ended December 31, 2021. The company prepares this statement using the indirect method.

c. Calculate the company’s free cash flow and discuss the company’s cash flow pattern including details about sources and uses of cash.

d. How can the information from the SFP/BS and statement of cash flows be beneficial to the company stakeholders (e.g., creditors, investors, management and others)?

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning