Computer Associates International, Inc., is the world's largest business software company. The company offers more applications on

Question:

Computer Associates International, Inc., is the world's largest business software company. The company offers more applications on more kinds of platforms to more kinds of corporations than any other company in the computer industry. The company was founded in 1977 with four employees and has grown to 9,000 employees, 500 products, 100,000 clients, and about 3.5 billion in revenues.

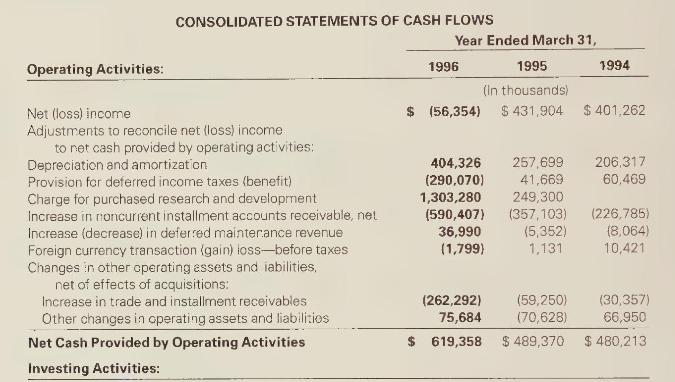

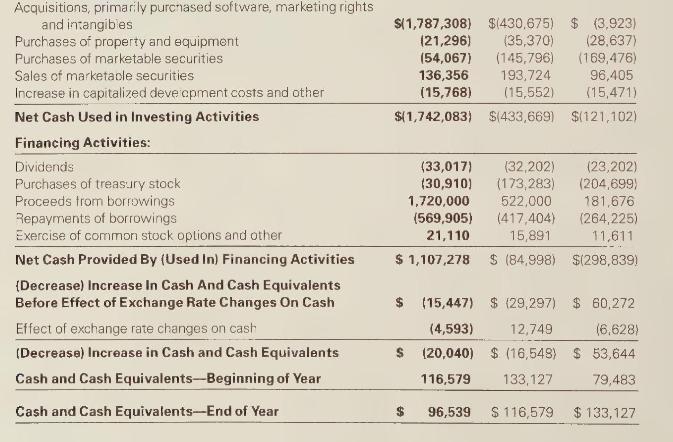

The company's statements of cash flows for the years 1994 through 1996 follow. Then the relevant portion of Management's Discussion and Analysis of the statement of cash flows is provided.

\section*{Management's Discussion and Analysis*}

\section*{LIQUIDITY AND CAPITAL RESOURCES}

Cash from operations for the year ended March 31, 1996 increased by \(\$ 130\) million, or \(27 \%\), over the preceding fiscal year. The increase was primarily the result of increased net income, excluding the noncash charge to earnings for purchased research and development. While absolute accounts receivable balances have increased during fiscal 1996 reflecting the clients' higher propensity to finance licensing fees, collection of billed receivables has reduced the amount of time such receivables are outstanding. Installment, or unbilled, receivables have grown proportionally with revenue and continue to be viewed by the Company both as a competitive advantage when marketing product as well as a beneficial use of the Company's capital. Cash generated from operations and maturities of marketable securities were used to reduce debt drawn as a result of the August 1995 Legent acquisition. The Company's fiscal 1996 open market purchases of its common stock of \(\$ 31\) million was significantly lower than that of the prior year primarily due to concerted efforts to reduce the debt levels associated with the Legent acquisition.

In August 1995, the Company's revolving line of credit was renegotiated from \(\$ 500\) million to \(\$ 2\) billion to fund the \(\$ 1.8\) billion acquisition of Legent. Under the new credit facility, borrowings are subject to interest primarily at the prevailing London interbank rate ("LIBOR") plus a fixed spread dependent on the achievement of certain financial ratios. The agreement provides for a facility fee, also dependent on the achievement of certain financial ratios. The facility calls for the maintenance of certain financial conditions. The Company also has \(\$ 23\) million of unsecured and uncommitted multicurrency lines of credit available. These multicurrency facilities were established to meet any short-term working capital requirements for subsidiaries principally outside the United States. Peak borrowings under all financing arrangements were \(\$ 1,845\) million during fiscal 1996 , and the weighted average interest rate for those borrowings was \(6.5 \%\). Peak borrowings under credif facilities during fiscal 1995 were \(\$ 392\) million and the weighted average interest rate for these borrowings was \(5.3 \%\). At March 31, 1996 approximately \(\$ 1.4\) billion was outstanding under these credit arrangements.

In April 1996, the Company further restructured a portion of its debt by completing a \(\$ 320\) million private placement of debt. The private placement affords the Company several advantages including extending the maturity of its debt, locking in a favorable interest rate and broadening the Company's sources of liquidity.

The Company's capital resource commitment as of March 31, 1996, consisted of lease obligations for office facilities, computer equipment, a mortgage obligation and amounts due resulting from the acquisition of products and companies. The Company intends to meet its capital resource requirements from its available funds. No significant commitments exist for future capital expenditures.

The Company believes that the foregoing sources of liquidity, plus existing cash and marketable securities balances of \(\$ 201\) million as of March 31, 1996, are adequate for its foreseeable operating needs.

The Company purchased approximately 750 thousand shares of its Common Stock under its open market repurchase program during fiscal 1996, bringing the total purchased under this program to approximately

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards