Connie Dalton owns and operates a sporting goods store. On February 2, 1998, the store suffered extensive

Question:

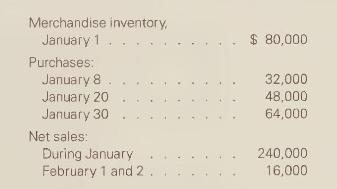

Connie Dalton owns and operates a sporting goods store. On February 2, 1998, the store suffered extensive fire damage, and all of the inventory was destroyed. Dalton uses periodic inventory procedure and has the following information in her accounting records, which were undamaged:

Dalton's gross margin rate on net sales has been \(40 \%\) for the past three years. Her insurance company offered to pay \(\$ 56,000\) to settle this inventory loss unless Dalton can show that she suffered a greater loss. She has asked you, her CPA, to help her in determining her loss.

Answer these questions: Based on your analysis, should Dalton settle for \(\$ 56,000\) ? If not, how can she show that she suffered a greater loss? What is your estimate of her loss?

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards