Cook, Jing, and Schwartz formed the CJS Partnership by making investments of $144,000, $216,000, and $120,000, respectively.

Question:

Cook, Jing, and Schwartz formed the CJS Partnership by making investments of $144,000, $216,000, and $120,000, respectively. They predict annual partnership net income of $240,000 and are considering the following alternative plans of sharing income and loss:

(a) Equally;

(b) In the ratio of their initial capital investments;

(c) Salary allowances of $40,000 to Cook, $30,000 to Jing, and $80,000 to Schwartz; interest allowances of 12% on their initial capital investments; and the remaining balance shared equally.

Required

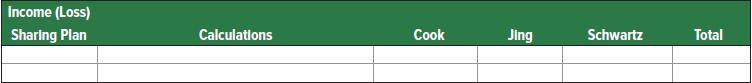

1. Prepare a table with the following column headings. Use the table to show how to distribute net income of $240,000 for the calendar year under each of the alternative plans being considered. 2. Prepare a statement of partners’ equity showing the allocation of income to the partners assuming they agree to use plan c; that income earned is $87,600; and that Cook, Jing, and Schwartz withdraw $18,000, $38,000, and $24,000, respectively, at year-end.

2. Prepare a statement of partners’ equity showing the allocation of income to the partners assuming they agree to use plan c; that income earned is $87,600; and that Cook, Jing, and Schwartz withdraw $18,000, $38,000, and $24,000, respectively, at year-end.

3. Prepare the December 31 journal entry to close Income Summary assuming they agree to use plan c and that net income is $87,600. Also close the withdrawals accounts.

Step by Step Answer:

Principles Of Financial Accounting (Chapters 1-17)

ISBN: 9781260780147

25th Edition

Authors: John Wild