Currently, many corporations are looking for acquisition opportunities. Tyre, Inc., is trying to decide whether to buy

Question:

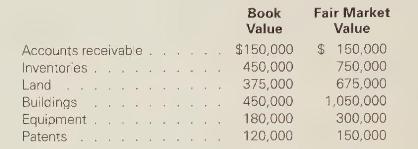

Currently, many corporations are looking for acquisition opportunities. Tyre, Inc., is trying to decide whether to buy Amite Company or Beauman Company. Tyre, Inc., has hired you as a consultant to analyze the two companies' financial information and to determine the more advantageous acquisition. Your review of the companies' books has revealed that both Amite and Beauman have assets with the following book values and fair market values:

Liabilities assumed on the purchase of either company include accounts payable, \(\$ 300,000\), and notes payable, \(\$ 75,000\).

The only difference between the companies is that Amite has net income that is about average for the industry, while Beauman's net income is greatly above average for the industry.

Required Top-level management at Tyre, Inc., has asked you to respond in writing to the following possible situations:

a. Assume Tyre, Inc., can buy Amite Company for \(\$ 2,700,000\) or Beauman Company for \(\$ 3,450,000\). Prepare the journal entries to record the acquisition of Amite Company and Beauman Company. What accounts for the difference between the purchase price of the two companies?

b. Assume Tyre, Inc, can buy either company for \(\$ 2,700,000\). Write a report for Tyre, Inc., advising which company to buy.

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards