For each of the separate cases in Exercise 3-13, determine the financial statement impact of each required

Question:

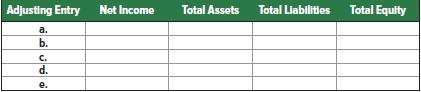

For each of the separate cases in Exercise 3-13, determine the financial statement impact of each required year-end adjusting entry. Fill in the table below by indicating the amount and direction (+ or −) of the effect.

Data from Exercise 3-13

For each of the following separate cases, prepare the required December 31 year-end adjusting entries.a. Depreciation on the company’s wind turbine equipment for the year is $5,000.b. The Prepaid Insurance account for the solar panels had a $2,000 debit balance at December 31 before adjusting for the costs of any expired coverage. Analysis of prepaid insurance shows that $600 of unexpired insurance coverage remains at year-end.

c. The company received $3,000 cash in advance for sustainability consulting work. As of December 31, one-third of the sustainability consulting work had been performed.d. As of December 31, $1,200 in wages expense for the organic produce workers has been incurred but not yet paid.e. As of December 31, the company has earned, but not yet recorded, $400 of interest revenue from investments in socially responsible bonds. The interest revenue is expected to be received on January 12.

Step by Step Answer:

Principles Of Financial Accounting (Chapters 1-17)

ISBN: 9781260780147

25th Edition

Authors: John Wild