Heather and Dan Holt met while both were employed in the interior trim and upholstery department of

Question:

Heather and Dan Holt met while both were employed in the interior trim and upholstery department of an auto manufacturer. After their marriage, they decided to earn some extra income by doing small jobs involving canvas, vinyl, and upholstered products. Their work was considered excellent, and at the urging of their customers, they decided to go into business for themselves, operating out of the basement of the house they owned. To do this, they invested \(\$ 120,000\) cash in their business. They spent \(\$ 10,500\) for a sewing machine (expected life, 10 years) and \(\$ 12,000\) for other miscellaneous tools and equipment (expected life, 5 years). They undertook only custom work, with the customers purchasing the required materials, to avoid stocking any inventory other than supplies. Generally, they required an advance deposit on all jobs.

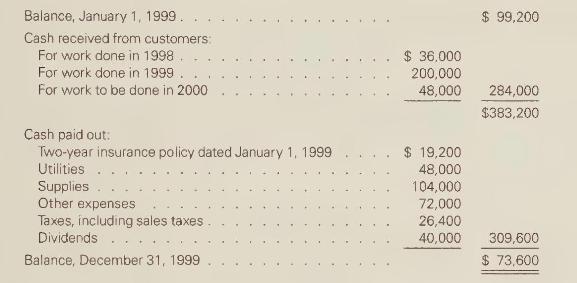

The business seemed successful from the start, as the Holts received orders from many customers. But they felt something was wrong. They worked hard and charged competitive prices. Yet there seemed to be barely enough cash available from the business to cover immediate personal needs. Summarized, the checkbook of the business for 1999, their second year of operations, showed:

Considering how much they worked, the Holts were concerned that the cash balance decreased by \(\$ 25,600\) even though they only received dividends of \(\$ 40,000\). Their combined income from the auto manufacturer had been \(\$ 45,000\). They were seriously considering giving up their business and going back to work for the auto manufacturer. They turned to you for advice. You discovered the following:

1. Of the supplies purchased in \(1999, \$ 24,000\) were used on jobs billed to customers in 1999; no supplies were used for any other work.

2. Work completed in 1999 and billed to customers for which cash had not yet been received by year-end amounted to \(\$ 40,000\).

Prepare a written report for the Holts, responding to their belief that their business is not sufficiently profitable. (Hint: Prepare an income statement for 1999 and include it in your report.)

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards