Neva Nadal started a new business, Nadal Computing, and completed the following transactions during its first year

Question:

a. Neva Nadal invested $90,000 cash and office equipment valued at $10,000 in the company.

b. The company purchased an office suite for $50,000 cash.

c. The company purchased office equipment for $25,000 cash.

d. The company purchased $1,200 of office supplies and $1,700 of office equipment on credit.

e. The company paid a local newspaper $750 cash for printing an announcement of the office€™s opening.

f. The company completed a financial plan for a client and billed that client $2,800 for the service.

g. The company designed a financial plan for another client and immediately collected a $4,000 cash fee.

h. Neva Nadal withdrew $11,500 cash from the company for personal use.

i. The company received $1,800 cash from the client described in transaction f.

j. The company made a payment of $700 cash on the equipment purchased in transaction d.

k. The company paid $2,500 cash for the office secretary€™s wages.

Required

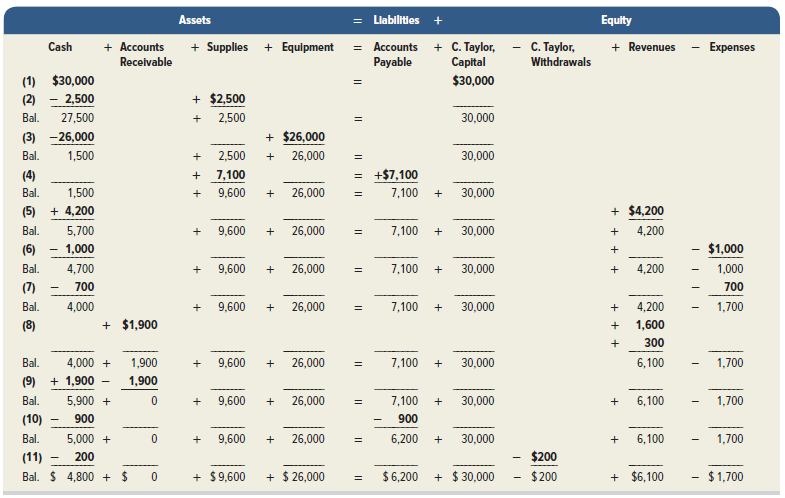

1. Create the following table similar to the one in Exhibit 1.9.

EXHIBIT 1.9: Summary of Transactions Using the Accounting Equation

Use additions and subtractions within the table to show the dollar effects of each transaction on individual items of the accounting equation. Show new balances after each transaction.

2. Determine the company€™s net income.

Step by Step Answer:

Principles of Financial Accounting chapters 1-17

ISBN: 978-1259687747

23rd edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta