PMT Services, Inc., is an independent service organization that markets and services electronic credit card authorization and

Question:

PMT Services, Inc., is an independent service organization that markets and services electronic credit card authorization and payment systems to small retail, wholesale, and professional businesses located throughout the United States. Prior to installing PMT's electronic system, most of these businesses have used manual, paper-based systems to process credit card transactions or have not accepted credit cards at all. As the use of credit cards has significantly expanded, electronic processing has proven more convenient by accelerating customer purchases, lowering processing expenses, and reducing losses from fraudulent cards.

PMT's account portfolio has grown through the purchase of account portfolios as well as through the internal development of accounts using telemarketing and field sales. With ap- proximately 89,500 accounts at July 31,1996, PMT is one of the largest independent service organizations in the country.

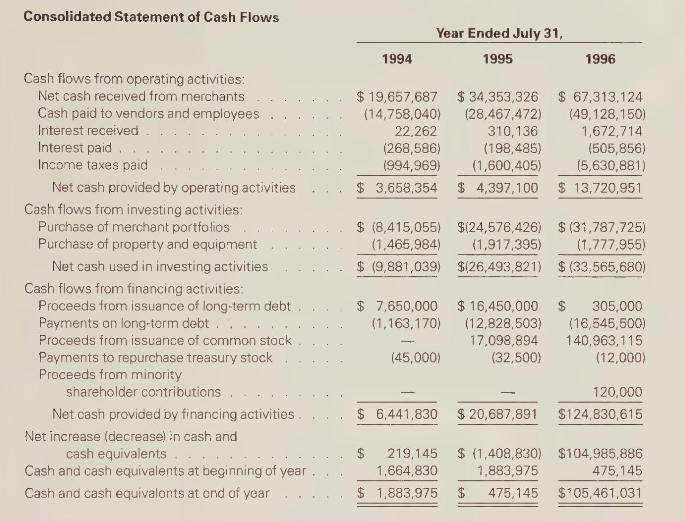

The company's statements of cash flows for the years 1994-1996 follow. Then the relevant portion of Management's Discussion and Analysis of the statement of cash flows is provided.

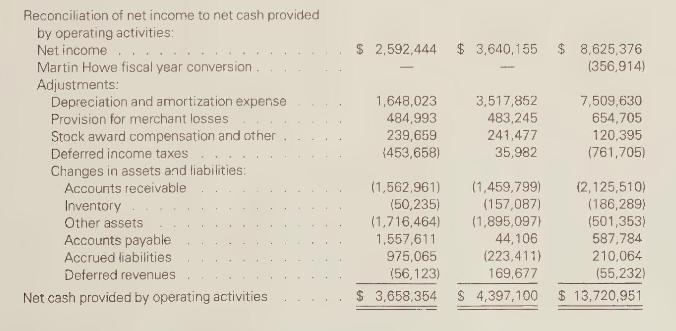

Supplemental schedule of noncash activities:

In connection with the purchase of merchant portfolios in fiscal years 1994 and 1995, the Company issued promissory notes totaling \(\$ 5,061,804\) and \(\$ 80,500\), respectively.

The Company recognized a tax benefit of \(\$ 318,517\) for the year ended July 31, 1996 for the excess of the fair market value at the exercise date over that at the award date for stock options exercised. In connection with the purchase of a merchant portfolio in March 1994, the Company issued 312,500 shares of common stock In connection with an agreement between the Company and a processing bank entered into simultaneously with the purchase of a merchant portfolio in March 1994, the Company issued warrants to purchase 120,000 shares of common stock.

\section*{Management's Discussion and Analysis}

\section*{Liquidity and Capital Resources*}

The Company recognizes as revenue in its statement of income the full discount rate and related fees collected from the merchant. The various costs incurred by the Company, including amounts paid to the card-issuing bank, the processing bank, and the network service provider, are reflected as costs of revenues. In accordance with the Company's contracts with its processing banks, all the funds collection and most of the disbursement function is performed on behalf of the Company by the processing bank. At month end the processing bank collects the total discount rate and related fees from the merchants and disburses to each of the service providers their fees, except disbursements for interchange fees paid to the card-issuing bank are made daily. Shortly after month end, the processing bank disburses to the Company the remainder of the funds collected from the merchant (which represents a significant portion of the Company's gross margin).

Although the Company's revenues reflect the full discount rate and related fees collected, the cash flow statement is prepared using the "direct method" as provided in SFAS 95, "Statement of Cash Flows," and reflects cash received from merchants at the net amount collected as the cash flows received by the Company from processing banks are net of the amounts disbursed to the other parties described above. This presentation follows the actual flow of funds to the Company.

Several factors can alter the profitability to the Company of merchant transactions. Primarily, these include (i) improper use of the card reading terminal by the merchant resulting in higher interchange fees paid to the card-issuing bank, (ii) lower than anticipated average dollar sales of credit card transactions thereby reducing the discount rate collected because many of the transaction costs are fixed, (iii) losses incurred as a result of customer chargebacks (the Company can be required to absorb the full retail purchase amount), (iv) the inability to collect the discount rate because of insufficient funds in the merchant's bank account, (v) merchant fraud and (vi) excessive volume of customer return transactions in which the Company again incurs all costs except interchange fees. Actual losses realized as a result of customer chargebacks, merchant fraud and the Company's inability to collect the discount rate as a result of insufficient merchant funds were approximately \(\$ 399,000\) and \(\$ 721,000\) for fiscal year 1995 and fiscal year 1996, respectively. The Company's actual losses as a percentage of total revenues realized remained consistent from fiscal 1995 to fiscal 1996. Management does not believe that the other factors mentioned above have had a material effect on the Company's profitability.

\section*{Working Capital}

Cash flow provided by operating activities was \(\$ 3.7\) million in fiscal year 1994 as compared to \(\$ 4.4\) million in fiscal year 1995 and \(\$

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards