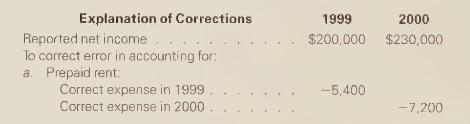

The reported net income amounts for Safety Waste Control Company were 1999, $200,000; and (2000, $ 230,000).

Question:

The reported net income amounts for Safety Waste Control Company were 1999, \$200,000; and \(2000, \$ 230,000\). No annual adjusting entries were made at either year-end for any of these transactions:

a. A building was rented on April 1, 1999. Cash of \(\$ 14,400\) was paid on that date to cover a two-year period. Prepaid Rent was debited.

b. The balance in the Office Supplies on Hand account on December 31, 1999, was \(\$ 6,000\). An inventory of the supplies on December 31,1999 , revealed that only. \(\$ 3,500\) were actually on hand at that date. No new supplies were purchased during 2000. At December 31, 2000, an inventory of the supplies revealed that \(\$ 800\) were on hand.

c. A building costing \(\$ 1,200,000\) and having an estimated useful life of 40 years and a salvage value of \(\$ 240,000\) was put into service on January 1,1999 .

d. Services were performed for customers in December 1999 . The \(\$ 24,000\) bill for these services was not sent until January 2000 . The only transaction that was recorded was a debit to Cash and a credit to Service Revenue when payment was received in January.

Calculate the correct net income for 1999 and 2000. In your answer, start with the reported net income amounts. Then show the effects of each correction (adjustment) using a plus or a minus to indicate whether reported income should be increased or decreased as a result of the correction. When the corrections are added to or deducted from the reported net income amounts, the result should be the correct net income amounts. The answer format should be as follows

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards