The trial balance of California Tennis Center, Inc., at the end of the first 11 months of

Question:

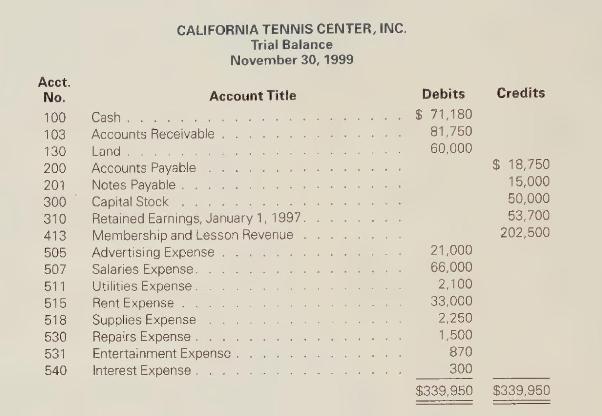

The trial balance of California Tennis Center, Inc., at the end of the first 11 months of its fiscal year follows:

Required post to three-column ledger The trial balance of California Tennis Center, Inc., at the end of the first 11 months of its fiscal year follows:

\section*{CALIFORNIA TENNIS CENTER, INC. Trial Balance \\ November 30, 1999}

\begin{tabular}{|c|c|c|c|}

\hline \begin{tabular}{l}

Acct. \\

No.

\end{tabular} & Account Title & Debits & Credits \\

\hline 100 & Cash . & \(\$ 71,180\) & \\

\hline 103 & Accounts Receivable & 81,750 & \\

\hline 130 & Land . . . . . . . & 60,000 & \\

\hline 200 & Accounts Payable & & \(\$ 18,750\) \\

\hline 201 & Notes Payable . . & & 15,000 \\

\hline 300 & Capital Stock & & 50,000 \\

\hline 310 & Retained Earnings, January 1, 1997. & & 53,700 \\

\hline 413 & Membership and Lesson Revenue . & & 202,500 \\

\hline 505 & Advertising Expense & 21,000 & \\

\hline 507 & Salaries Expense. & 66,000 & \\

\hline 511 & Utilities Expense. & 2,100 & \\

\hline 515 & Rent Expense & 33,000 & \\

\hline 518 & Supplies Expense & 2,250 & \\

\hline 530 & Repairs Expense . & 1,500 & \\

\hline 531 & Entertainment Expense . & 870 & \\

\hline \multirow[t]{2}{*}{540} & Interest Expense . . & 300 & \\

\hline & & \(\overline{\$ 339,950}\) & \(\$ 339,950\) \\

\hline \end{tabular}

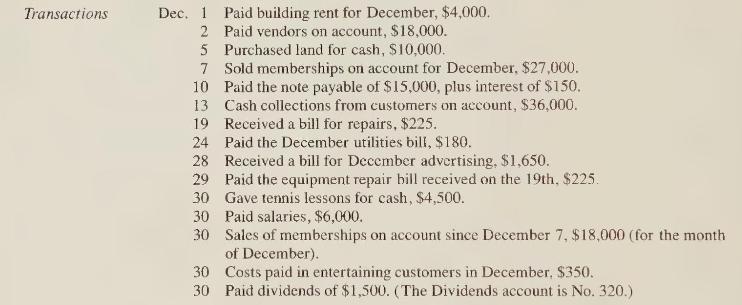

Dec. 1 Paid building rent for December, \(\$ 4,000\).

2 Paid vendors on account, \(\$ 18,000\).

5 Purchased land for cash, \(\$ 10,000\).

7 Sold memberships on account for December, \(\$ 27,000\).

10 Paid the note payable of \(\$ 15,000\), plus interest of \(\$ 150\).

13 Cash collections from customers on account, \(\$ 36,000\).

19 Received a bill for repairs, \(\$ 225\).

24 Paid the December utilities bill, \(\$ 180\).

28 Received a bill for December advertising, \$1,650.

29 Paid the equipment repair bill received on the 19 th, \(\$ 225\).

30 Gave tennis lessons for cash, \(\$ 4,500\).

30 Paid salaries, \(\$ 6,000\).

30 Sales of memberships on account since December \(7, \$ 18,000\) (for the month of December).

30 Costs paid in entertaining customers in December, \(\$ 350\).

30 Paid dividends of \(\$ 1,500\). (The Dividends account is No. 320.)

a. Open three-column general ledger accounts for each of the accounts in the trial balance. Place the word Balance in the explanation space and enter the date December 1, 1999, on this same line. Also open an account for Dividends, No. 320.

b. Prepare entries in the general journal for the transactions during December 1999.

c. Post the journal entries to three-column ledger accounts.

d. Prepare a trial balance as of December 31, 1999.

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards