A common-size income statement for Santa Enterprises 2017 operations follows. Using the firms 2017 income statement, develop

Question:

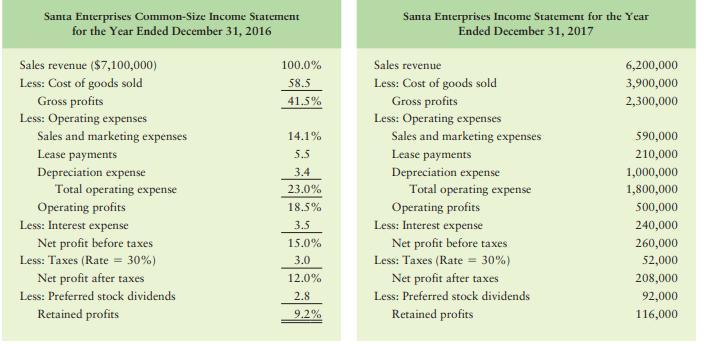

A common-size income statement for Santa Enterprises’ 2017 operations follows. Using the firm’s 2017 income statement, develop the 2017 common-size income statement and compare it with the 2016 statement. Which areas require further analysis and investigation?

Transcribed Image Text:

Santa Enterprises Common-Size Income Statement for the Year Ended December 31, 2016 Sales revenue ($7,100,000) Less: Cost of goods sold Gross profits Less: Operating expenses Sales and marketing expenses Lease payments Depreciation expense Total operating expense Operating profits Less: Interest expense Net profit before taxes Less: Taxes (Rate = 30%) Net profit after taxes Less: Preferred stock dividends Retained profits 100.0% 58.5 41.5% 14.1% 5.5 3.4 23.0% 18.5% 3.5 15.0% 3.0 12.0% 2.8 9.2% Santa Enterprises Income Statement for the Year Ended December 31, 2017 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Sales and marketing expenses Lease payments Depreciation expense Total operating expense Operating profits Less: Interest expense Net profit before taxes Less: Taxes (Rate = 30%) Net profit after taxes Less: Preferred stock dividends Retained profits 6,200,000 3,900,000 2,300,000 590,000 210,000 1,000,000 1,800,000 500,000 240,000 260,000 52,000 208,000 92,000 116,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Certainly Lets analyze the commonsize income statements for Santa Enterprises in 2016 and 2017 Well ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted:

Students also viewed these Business questions

-

What amount of gain should Pharoah recognize on the exchange assuming lack of commercial substance?

-

A common-size income statement for Creek Enterprises 2014 operations follows. Using the firms 2015 income statement presented in Problem 318 develop the 2015 common-size income statement and compare...

-

A common-size income statement for Creek Enterprises 2018 operations follows. Using the firms 2019 income statement presented in Problem 316, develop the 2019 common-size income statement and compare...

-

L-keys, such as the one shown in the figure below, are commonly used to insert screws and bolts in medical implants. This insertion process can be simplified into the loading scenario shown in the...

-

1. Time Interval Determine the amount of time required for money to double at 2% simple interest. 2. Interest Rate Derive the formula for the (simple) interest rate r at which P dollars grow to F...

-

The Blossom Company is a multidivisional company. Its managers have full responsibility for profits and complete autonomy to accept or reject transfers from other divisions. Division A produces a...

-

Sound waves from a basketball. Refer to the American Journal of Physics (June 2010) study of sound waves in a spherical cavity, Exercise 2.43 (p. 80). The frequencies of sound waves (estimated using...

-

The following stockholders equity accounts, arranged alphabetically, are in the ledger of Selig Corporation at December 31, 2010. Common Stock ($5 stated value, 800,000 shares authorized)...

-

Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year: Beginning Balance Ending Balance Raw...

-

The CEO of Dinnington Glass Company has approached Anne Hersch, the companys accountant, for an annual financial checkup. As the first step, Anne and her team have prepared a complete set of ratios...

-

The table below shows 2017 total revenues, cost of goods sold, earnings available for common stockholders, total assets, and stockholders equity for three companies competing in the local beverages...

-

Suppose that you have available as many i.i.d. standard normal pseudo-random numbers as you desire. Describe how you could simulate a pseudo-random number with an F distribution with four and seven...

-

solve for x 4 . 0 a 2 = 2 . 0 a x

-

BUSINESS SOLUTIONS Comparative Balance Sheets March 3 1 , 2 0 2 2 December 3 1 , 2 0 2 1 Assets Cash $ 8 4 , 7 8 7 $ 5 7 , 8 7 2 Accounts receivable 2 4 , 2 6 7 5 , 0 6 8 Inventory 6 1 4 0 Computer...

-

Solve:z-18=-103.

-

Complete the social penetration exercise and post your reactions in the discussion. PIRATION Purpose: 1. To help you understand the breadth and depth of self-disclosure. 2. To help you see the...

-

The implicit equation of x = sin ( t ) and y = 2 cos ( t ) is:

-

Why does a change in the foreign real interest rate lead to a shift of the AD curve?

-

Following is the current balance sheet for a local partnership of doctors: The following questions represent independent situations: a. E is going to invest enough money in this partnership to...

-

MSF Manufacturing Company is considering the purchase of a new machine to improve its production efficiency. The company has total current assets amounting to $865,000 and total current liabilities...

-

MSF Manufacturing Company is considering the purchase of a new machine to improve its production efficiency. The company has total current assets amounting to $865,000 and total current liabilities...

-

Miller Dental, Inc. is considering replacing its existing laser checking system, which was purchased 3 years ago at a cost of $568,000. The laser checking system can be sold for a lump sum of...

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

Study smarter with the SolutionInn App