Dacia Gears Ltd. has two alternative projects to choose from for their new distribution facility in Europe.

Question:

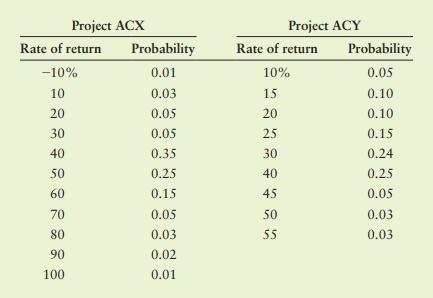

Dacia Gears Ltd. has two alternative projects to choose from for their new distribution facility in Europe. The annual rate of return and the related probabilities given in the following table summarize the firm’s analysis to this point.

a. For each project, compute:

(1) The range of possible rates of return.

(2) The average return.

(3) The standard deviation of the returns.

(4) The coefficient of variation of the returns.

b. Construct a bar chart of each distribution of rates of return.

c. Which project would you consider more risky? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: