Erwin Footwear wishes to assess the value of its Active Shoe Division. This division has debt with

Question:

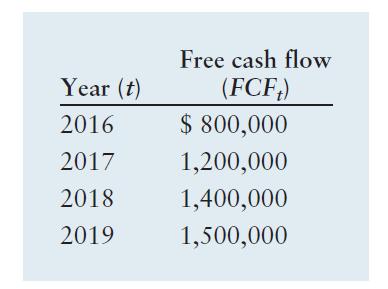

Erwin Footwear wishes to assess the value of its Active Shoe Division. This division has debt with a market value of $12,500,000 and no preferred stock. Its weighted average cost of capital is 10%. The Active Shoe Division’s estimated free cash flow each year from 2016 through 2019 is given in the following table. Beyond 2019 to infinity, the firm expects its free cash flow to grow at 4% annually.

a. Use the free cash flow valuation model to estimate the value of Erwin’s entire Active Shoe Division.

b. Use your finding in part a along with the data provided to find this division’s common stock value.

c. If the Active Shoe Division as a public company will have 500,000 shares outstanding, use your finding in part b to calculate its value per share.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter