Mayflower Interiors is evaluating three mutually exclusive projects. The cost of capital, r, is 13.5% and the

Question:

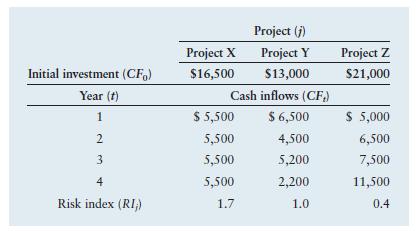

Mayflower Interiors is evaluating three mutually exclusive projects. The cost of capital, r, is 13.5% and the risk-free rate, RF, is 10%. The following information is available regarding the three mutually exclusive projects.

a. Calculate the net present value (NPV) of each project using the firm’s cost of capital. Based on your answer, which project should be accepted?

b. Mayflower Interiors prefers to use the risk-adjusted discount rate instead of the firm’s cost of capital. Calculate the risk-adjusted discount rate for each of the three projects using the RADRj equation below:

![]()

where

RF = risk-free rate of return

RIj = risk index for project j

r = cost of capital

c. Calculate the net present value (NPV) of each project using the risk-adjusted discount rate. Based on your answer, which project should be accepted?

d. Based on your answers in parts a and c, which project should be accepted? Explain your recommendation.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter