P1010 NPV: Mutually exclusive projects Hook Industries is considering the replacement of one of its old drill

Question:

P10–10 NPV: Mutually exclusive projects Hook Industries is considering the replacement of one of its old drill presses. Three alternative replacement presses are under consideration.

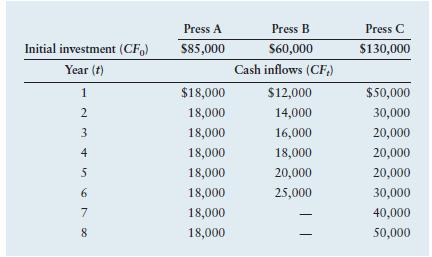

The relevant cash flows associated with each are shown in the following table.

The firm’s cost of capital is 15%.

a. Calculate the net present value (NPV) of each press.

b. Using NPV, evaluate the acceptability of each press.

c. Rank the presses from best to worst using NPV.

d. Calculate the profitability index (PI) for each press.

e. Rank the presses from best to worst using PI.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter

Question Posted: