P1023 NPV, IRR, and NPV profiles Thomas Company is considering two mutually exclusive projects. The firm, which

Question:

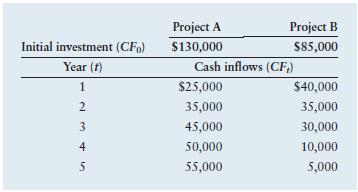

P10–23 NPV, IRR, and NPV profiles Thomas Company is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table

a. Calculate the NPV of each project, and assess its acceptability.

b. Calculate the IRR for each project, and assess its acceptability.

c. Draw the NPV profiles for both projects on the same set of axes.

d. Evaluate and discuss the rankings of the two projects on the basis of your findings in parts

a, b, and c.

e. Explain your findings in part d in light of the pattern of cash inflows associated with each project.

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter

Question Posted: