P1133 Capital rationing: IRR and NPV approaches Valley Corporation is attempting to select the best of a

Question:

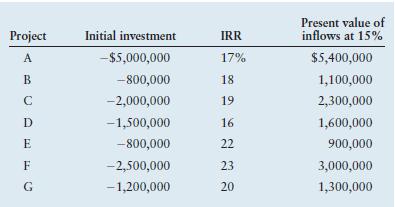

P11–33 Capital rationing: IRR and NPV approaches Valley Corporation is attempting to select the best of a group of independent projects competing for the firm’s fixed capital budget of $4.5 million. The firm recognizes that any unused portion of this budget will earn less than its 15% cost of capital, thereby resulting in a present value of inflows that is less than the initial investment. The firm has summarized, in the following table, the key data to be used in selecting the best group of projects.

a. Use the internal rate of return (IRR) approach to select the best group of projects.

b. Use the net present value (NPV) approach to select the best group of projects.

c. Compare, contrast, and discuss your findings in parts a and b.

d. Which projects should the firm implement? Why?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter