P551 Growth rates You are given the series of cash flows shown in the following table. a.

Question:

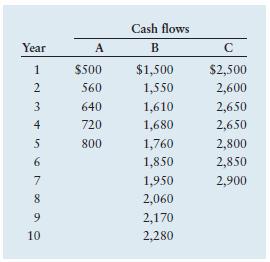

P5–51 Growth rates You are given the series of cash flows shown in the following table.

a. Calculate the compound annual growth rate between the first and last payment in each stream.

b. If year-1 values represent initial deposits in a savings account paying annual interest, what is the annual rate of interest earned on each account?

c. Compare and discuss the growth rate and interest rate found in parts a and

b, respectively.

P5–52 Rate of return Rishi Singh has $1,500 to invest. His investment counselor suggests an investment that pays no stated interest but will return $2,000 at the end of 3 years.

a. What annual rate of return will Rishi earn with this investment?

b. Rishi is considering another investment, of equal risk, that earns an annual return of 8%. Which investment should he make, and why?

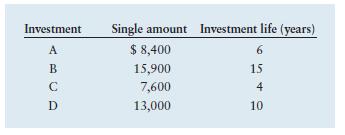

P5–53 Rate of return and investment choice Clare Jaccard has $5,000 to invest. Because she is only 25 years old, she is not concerned about the length of the investment’s life. What she is sensitive to is the rate of return she will earn on the investment.

With the help of her financial advisor, Clare has isolated four equally risky investments, each providing a single amount at the end of its life, as shown in the following table. All the investments require an initial $5,000 payment.

a. Calculate, to the nearest 1%, the rate of return on each of the four investments available to Clare.

b. Which investment would you recommend to Clare, given her goal of maximizing the rate of return?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter