P619 Bond value and time: Changing required returns Lynn Parsons is considering investing in either of two

Question:

P6–19 Bond value and time: Changing required returns Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 11% coupon interest rates and pay annual interest. Bond A has exactly 5 years to maturity, and bond B has 15 years to maturity.

a. Calculate the value of bond A if the required return is (1) 8%, (2) 11%, and

(3) 14%.

b. Calculate the value of bond B if the required return is (1) 8%, (2) 11%, and

(3) 14%.

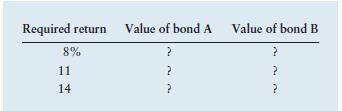

c. From your findings in parts a and

b, complete the following table, and discuss the relationship between time to maturity and changing required returns.

d. If Lynn wanted to minimize interest rate risk, which bond should she purchase?

Why?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter