P722 Integrative: Risk and valuation Giant Enterprises stock has a required return of 14.8%. The company, which

Question:

P7–22 Integrative: Risk and valuation Giant Enterprises’ stock has a required return of 14.8%.

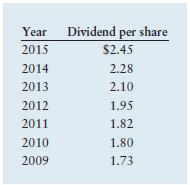

The company, which plans to pay a dividend of $2.60 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2009–2015 period, when the following dividends were paid.

a. If the risk-free rate is 10%, what is the risk premium on Giant’s stock?

b. Using the constant-growth model, estimate the value of Giant’s stock.

c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant’s stock.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter

Question Posted: