P830 Integrative: Risk, return, and CAPM Wolff Enterprises must consider several investment projects, A through E, using

Question:

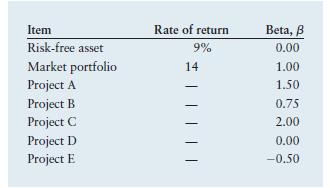

P8–30 Integrative: Risk, return, and CAPM Wolff Enterprises must consider several investment projects, A through E, using the capital asset pricing model (CAPM) and its graphical representation, the security market line (SML). Relevant information is presented in the following table.

a. Calculate (1) the required rate of return and (2) the risk premium for each project, given its level of nondiversifiable risk.

b. Use your findings in part a to draw the security market line (required return relative to nondiversifiable risk).

c. Discuss the relative nondiversifiable risk of projects A through E.

d. Assume that recent economic events have caused investors to become less riskaverse, causing the market return to decline by 2%, to 12%. Calculate the new required returns for assets A through E, and draw the new security market line on the same set of axes that you used in part b.

e. Compare your findings in parts a and b with those in part

d. What conclusion can you draw about the impact of a decline in investor risk aversion on the required returns of risky assets?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter