Projects is currently evaluating two new aluminum cutting machines with the intention of purchasing one of them.

Question:

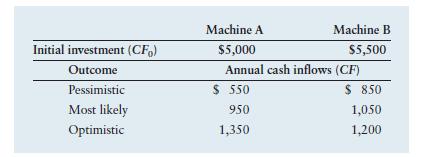

Projects is currently evaluating two new aluminum cutting machines with the intention of purchasing one of them. The economists estimated the pessimistic, most likely, and optimistic cash inflows for the two machines, which are shown in the following table. Both machines have 12-year lives.

a. Determine the range of the annual cash inflows for each of the two machines.

b. Aluminum Projects has a cost of capital of 10%. Construct a table with the NPVs for each of the two machines. Include the range of NPVs for each machine.

c. Based on the range of the cash flows and the NPVs of each machine, which machine should be acquired?

d. In which machine should Aluminium Projects invest if the company is not willing to take risks? Why?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter