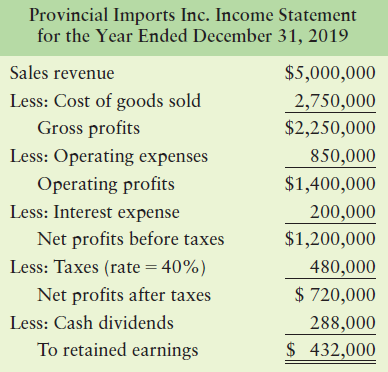

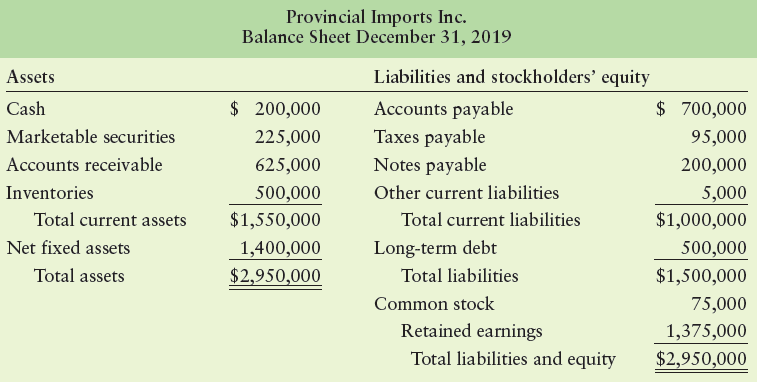

Provincial Imports Inc. has assembled past (2019) financial statements (income statement and balance sheet below) and financial

Question:

Provincial Imports Inc. has assembled past (2019) financial statements (income statement and balance sheet below) and financial projections for use in preparing financial plans for the coming year (2020).

Information related to financial projections for the year 2020 is as follows:

(1) Projected sales are $6,000,000.

(2) Cost of goods sold in 2019 includes $1,000,000 in fixed costs.

(3) Operating expense in 2019 includes $250,000 in fixed costs.

(4) Interest expense will remain unchanged.

(5) The firm will pay cash dividends amounting to 40% of net profits after taxes.

(6) Cash and inventories will double.

(7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

(8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales.

(9) A new computer system costing $356,000 will be purchased during the year.

Total depreciation expense for the year will be $110,000.

(10) The tax rate will remain at 40%.

a. Prepare a pro forma income statement for the year ended December 31, 2020, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

b. Prepare a pro forma balance sheet as of December 31, 2020, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account.

c. Analyze these statements, and discuss the resulting external financing required.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart