Roots to Branches Corporation, a company specializing in event dcor, is considering two mutually exclusive investments: Roots

Question:

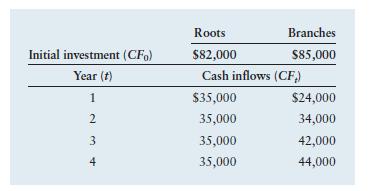

Roots to Branches Corporation, a company specializing in event décor, is considering two mutually exclusive investments: “Roots” and “Branches.” Both investments will assist the company with the décor arrangements in buildings with high ceilings. Management expects that the market rate of return is 10% while the risk-free rate of return is 6.5%. The cash flows of the two investments are shown in the following table.

a. Calculate the risk-adjusted net present value of the two investments. The RADR factor for the Roots investment is 1.4 while the RADR factor for the Branches investment is 1.6.

b. Which investment would you recommend? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: