Space Software is considering an investment in a new software that detects malware threats in the financial

Question:

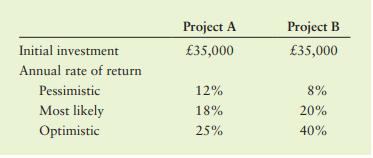

Space Software is considering an investment in a new software that detects malware threats in the financial industry. Two possible types of expansion are under review. After investigating the possible outcomes, the company made the estimates shown in the following table. The pessimistic and optimistic outcomes occur with a probability of 20% and 25%, respectively, and the most likely outcome occurs with a probability of 55%.

a. Determine the range of rates of return for each of the two projects.

b. Which project seems less risky? Why?

c. If you were making the investment decision, which one would you chose? Why?

d. Assume that project B’s most likely outcome is 21% per year and that all other facts remain the same. Does your answer to part c now change? Why?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart