ST112 Risk-adjusted discount rates CBA Company is considering two mutually exclusive projects, A and B. The following

Question:

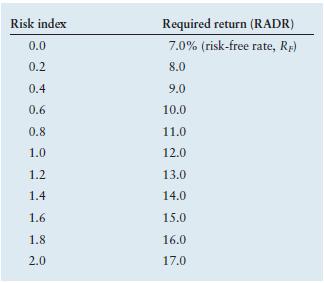

ST11–2 Risk-adjusted discount rates CBA Company is considering two mutually exclusive projects, A and B. The following table shows the CAPM-type relationship between a risk index and the required return (RADR) applicable to CBA Company.

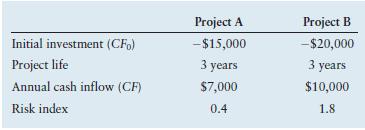

Project data are as follows:

a. Ignoring any differences in risk and assuming that the firm’s cost of capital is 10%, calculate the net present value (NPV) of each project.

b. Use NPV to evaluate the projects, using risk-adjusted discount rates (RADRs) to account for risk.

c. Compare, contrast, and explain your findings in parts a and b.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter

Question Posted: