16.7. The four transactions below were selected from the ledger of J. B. Adam regarding the disposal

Question:

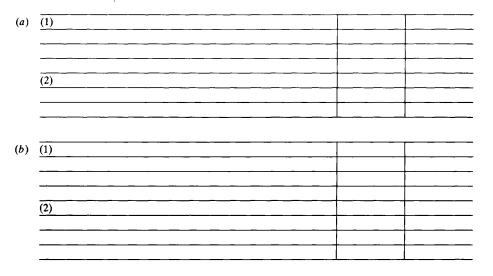

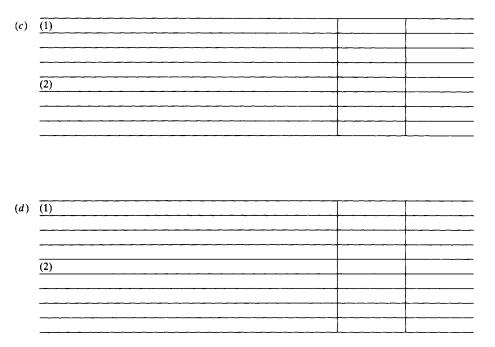

16.7. The four transactions below were selected from the ledger of J. B. Adam regarding the disposal of some of his fixed assets. Depreciation is considered to be recorded only to the end of the prior year. Present journal entries for each transaction. (Note: If an item is disposed of before the 15th, do not count the month.)

(a) Mar. 3 Discarded four typewriters, realizing no scrap value. Total cost. $3,000; accumulated depreciation as of Dec. 31. $2,000; annual depreciation, $360.

(b) Mar. 29 Sold office furniture for cash. $1,600. Total cost, $8,000; accumulated deprecia- tion through Dec. 31, $6,800; annual depreciation, $600.

(c) May 2 Traded in an old automobile for a new one priced at $4,000, receiving a trade-in allowance of $1,400 and paying the balance in cash. Data on the old automobile: cost, $3,900; accumulated depreciation. $2,700; annual deprecia- tion, $960.

(d) May 5 Traded in dictating equipment costing $1,000. with $800 accumulated deprecia- tion as of Dec. 31. The annual depreciation is $240. Received a trade-in allowance of $100, paying the balance in cash for a new dictating unit at $1,400.

Step by Step Answer:

Schaums Outline Of Principles Of Accounting I

ISBN: 978-0070381490

5th Edition

Authors: Joel Lerner ,James Cashin