Appliance Apps has the following costs associated with its production and sale of devices that allow appliances

Question:

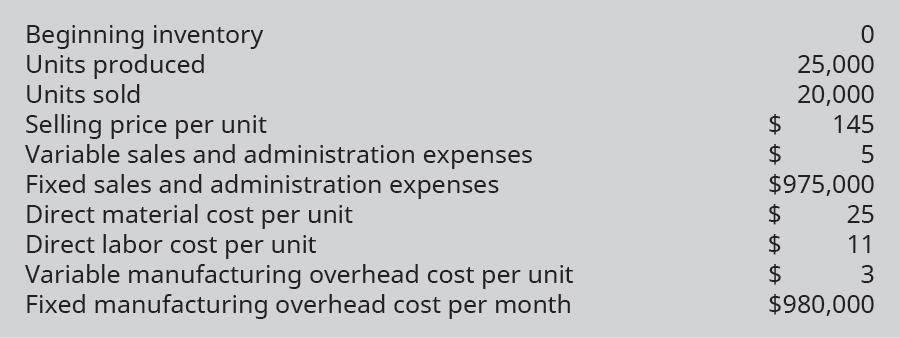

Appliance Apps has the following costs associated with its production and sale of devices that allow appliances to receive commands from cell phones.

Prepare an income statement under both the absorption and variable costing methods along with a reconciliation between the two statements.

Transcribed Image Text:

Beginning inventory Units produced Units sold Selling price per unit Variable sales and administration expenses Fixed sales and administration expenses Direct material cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost per month $ LA LA LA LA LA LA $ $ 0 25,000 20,000 $975,000 25 11 3 $ 145 5 $ $980,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

To prepare the income statement under both the absorption and variable costing methods and perform a reconciliation between the two we need to calcula...View the full answer

Answered By

Deepankur Keserwani

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted:

Students also viewed these Business questions

-

Wifi Apps has these costs associated with its production and sale of devices that allow visual communications between cell phones: Prepare an income statement under both the absorption and variable...

-

The offices and factory of Okanagan Company were destroyed by a flood on July 31, 2012, the year-end date of the company. Almost all of the accounting records were lost in the flood and the company...

-

On November 1, 2014, Best Corp. signed a three-month, zero-interest-bearing note for the purchase of $80,000 of inventory. The maturity value of the note was $81,200, based on the banks discount rate...

-

Monroe Inc. is an all-equity firm with 500,000 shares outstanding. It has $2,000,000 of EBIT, and EBIT is expected to remain constant in the future. The company pays out all of its earnings, so...

-

Comp America completed the following inventory transactions during the month of March: Requirements 1. Without resorting to calculations, determine which inventory method will result in Comp America...

-

Middleburg Golf Club, Inc., has assembled the following data for the year ended September 30, 2021: Prepare the operating activities section of Middleburg Golf Clubs statement of cash flows for the...

-

What is the purpose of the final meeting and presentation? AppendixLO1

-

Don Masters and two of his colleagues are considering opening a law office in a large metropolitan area that would make inexpensive legal services available to those who could not otherwise afford...

-

The acid test ratio measures a company's ability to pay off long-term liabilities with quick assets. Question 2 options: True False

-

Activity-based costing is preferable in a system: A. When multiple products have similar product volumes and costs B. With a large direct labor cost as a percentage of the total product cost C. With...

-

Crafts 4 All has these costs associated with production of 12,000 units of accessory products: direct materials, $19; direct labor, $30; variable manufacturing overhead, $15; total fixed...

-

The value of an automobile purchased in 2014 can be approximated by the function V (t) = 30(0.85) t , where t is the time, in years, from the date of purchase, and V (t) is the value, in thousands of...

-

At March 31, account balances after adjustments for Vizzini Cinema are as follows: Account Balances Accounts Cash Supplies Equipment (After Adjustment) $11,000 4,000 50,000 Accumulated...

-

2. "A student holds a thin aluminum pie pan horizontally 2 m above the ground and releases it. Using a motion detector, she obtains the graph shown in Figure P3.12. Based on her measurements, (a)...

-

Mark has two sticks, 25 inches, and 20 inches. If he places them end-to-end perpendicularly, what two acute angles would be formed when he added the hypotenuse?

-

A wedding website states that the average cost of a wedding is $29,205. One concerned bride hopes that the average is less than reported. To see if her hope is correct, she surveys 36 recently...

-

2. (10 pts each) Use partial fractions decomposition and the tables to find the inverse z- transform of each of the following: a. X(z)= 6z-z z3-4z2-z+4 4z2 b. G(z)=- (z-1) (z-0.5) 3z +1 c. X(z) =...

-

In July direct labor was 40% of conversion cost. If the manufacturing overhead cost for the month was $34,000 and the direct materials cost was $23,000, the direct labor cost was a. $22,667 b....

-

Draw the appropriate control flow graph of the given pseudocode.Make sure to only use one number for blocks of code which are all sequential and when the first line is executed, all of those lines...

-

For each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a ten-year remaining legal life was...

-

Ronson recently purchased a new boat to help ship product overseas. The following information is related to that purchase: Purchase price $4,500,000 Cost to bring boat to production facility...

-

Santa Rosa recently purchased a new boat to help ship product overseas. The following information is related to that purchase: Purchase price $4,500,000 Cost to bring boat to production facility...

-

Summarize in your own words Sharps, Treynors, and Jensens Measures for assessing portfolio performance with respect to risk. Assess the portfolio performance of mutual fund VDIGX taking into...

-

Question 1 Slat and Company have recently set up a business which will manufacture and sell a furniture component, the F12 On the 19 August 2021, the company issued 85,000 of share capital for cash....

-

The following is Addison Corporations contribution format income statements for last month. The company has no beginning or ending inventories. A total of 10,000 units were produced and sold last...

Study smarter with the SolutionInn App