Assume a company is going to make an investment in a machine of $825,000 and the following

Question:

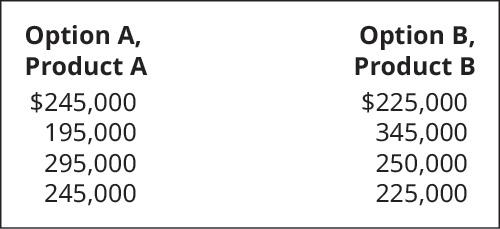

Assume a company is going to make an investment in a machine of $825,000 and the following are the cash flows that two different products would bring. Which of the two options would you choose based on the payback method?

Transcribed Image Text:

Option A, Product A $245,000 195,000 295,000 245,000 Option B, Product B $225,000 345,000 250,000 225,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

The payback method is a simple capital budgeting technique that measures the time it takes to recoup ...View the full answer

Answered By

Surendar Kumaradevan

I have worked with both teachers and students to offer specialized help with everything from grammar and vocabulary to challenging problem-solving in a range of academic disciplines. For each student's specific needs, I can offer explanations, examples, and practice tasks that will help them better understand complex ideas and develop their skills.

I employ a range of techniques and resources in my engaged, interesting tutoring sessions to keep students motivated and on task. I have the tools necessary to offer students the support and direction they require in order to achieve, whether they need assistance with their homework, test preparation, or simply want to hone their skills in a particular subject area.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted:

Students also viewed these Business questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Assume a company is going to make an investment of $450,000 in a machine and the following are the cash flows that two different products would bring in years one through four. Option A, Product A...

-

The Weld, Bergevin, and Magrath article points out that if a company is going to intentionally manipulate earnings, they must be astute enough to present financial statements that still seem...

-

Assume that a company is going to invest 900,000 USD in a new project. We expect that the invested capital in the fixed assets will be fully depreciated within 3 years as follows: 500,000 USD,...

-

From the following accounts (not in order), prepare a post-closing trial balance for Winter Co. on October 31, 201X. $19,950 9,700 P. Winter, Capital P. Winter, Withdrawals Accounts Receivable Legal...

-

Find u . (v x w). u = i v = j W = k

-

Left-tailed test, n = 6, a = 0.05 In Exercises 57-60, use a x-test to test the claim about the population variance o or standard deviation or at the given level of significance a and using the given...

-

On January 4, 2013, Runyan Bakery paid $324 million for 10 million shares of Lavery Labeling Company common stock . The investment represents a 30% interest in the net assets of Lavery and gave...

-

Analytics is now at the forefront of the insurance industry. Please describe the applicability of analytics to managing, retaining and transferring risk. Describe briefly the tools that are being...

-

Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to...

-

A restaurant is considering the purchase of new tables and chairs for their dining room with an initial investment cost of $515,000, and the restaurant expects an annual net cash flow of $103,000 per...

-

Larry Lair has recently been promoted to production manager, and so he has just Explain the production cost started to receive various managerial reports. One of the reports he has received is the...

-

Consider a system consisting of a colloidal particle of radius and charge Q-+20e (e is the charge of an electron) stationary in the center of a spherical cavity of radius R=5. Its counterions have...

-

Use the Empirical Rule to determine the percentage of candies with weights between 0.7 and 0.98 gram. Hint: x=0.84.

-

A sample of 16 items provides a sample standard deviation of 9.5. Test the following hypotheses using a = .05. Ho: 0250 2 Ha > 50 a. Calculate the value of the test statistic (to 2 decimals). 27.08...

-

During May, Darling Company incurred factory overhead costs as follows: indirect materials, $1,170; indirect labor, $2,000; utilities cost, $1,270; and factory depreciation, $5,850. Journalize the...

-

Practice 1 Let f(0) = cos(0). For each interval in the table below, determine the characteristics of f(e) Positive or negative Increasing or decreasing Concave up or concave down Let g(0) = 00

-

Describe the situations in which House's path-goal theory would expect (a) a participative leadership style and (b) a directive leadership style to work best.

-

Write the statement to store the contents of the txtAge control in an Integer variable named intAge.

-

You are a manager, and your direct report is complaining about not being involved in the planning process. How do you respond?

-

Use the tools described in this chapter to write a plan that will help you set goals, plans on how to achieve them (e.g., achieve an A average in all of my core concentration courses and A- in all...

-

Understand the importance of planning and why organizations need to plan and control.

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App