Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering

Question:

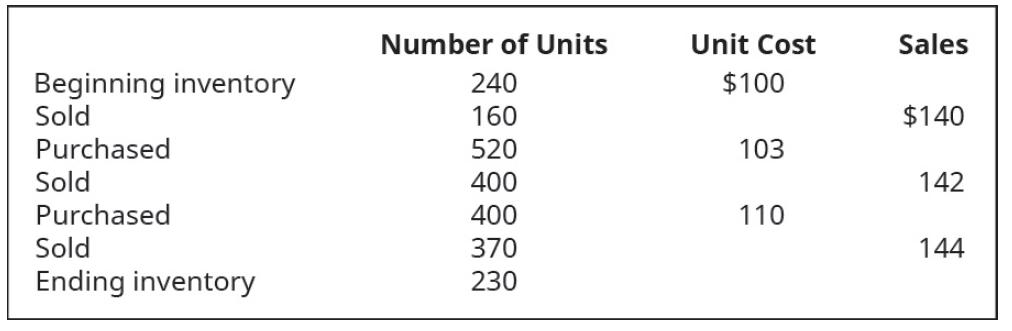

Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).

Transcribed Image Text:

Beginning inventory Sold Purchased Sold Purchased Sold Ending inventory Number of Units 240 160 520 400 400 370 230 Unit Cost $100 103 110 Sales $140 142 144

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

Firstin firstout FIFO method The FIFO method assumes that the oldest goods are sold first Using this ...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

Inventory turnover is calculated as cost of goods sold divided by ending inventory . 1. True 2. False

-

Using the following information, prepare the Cost of Goods Sold section of an income statement. Purchases Discounts .............. $ 8,500 Merchandise Inventory, December 31 ....... 189,000 Purchases...

-

Cost of Goods Sold is reported as an asset on the balance sheet. as a direct reduction of equity on the statement of changes in stockholders\' equity. as an addition to Sales Revenue on the income...

-

For the charge configuration of Prob. 2.15, find the potential at the center, using infinity as your reference point.

-

How does inflation affect the real return on holding cash?

-

1. A tool and die company buys a machine for $175,000 and it depreciates at a rate of 30% per year. (In other words, at the end of each year the depreciated value is 70% of what it was at the...

-

6.4 .488 A

-

On December 31, 2017, before the books were closed, the management and accountants of Madrasa Inc. made the following determinations about three pieces of equipment. 1. Equipment A was purchased...

-

Question 1 On January 1, the Newman Company estimated its property tax to be $5,100 for the year. (a) How much should the company accrue each month for property taxes? (b) Calculate the balance in...

-

In this mini-case, you will complete the test of details on accounts receivable for the 2019 audit of EarthWear Clothiers, Inc. The principal test of detail involves sending "confirmations" or...

-

Describe costing inventory using first-in, first-out. Address the different treatment, if any, that must be given for periodic and perpetual inventory updating.

-

Which of these statements is false? A. If cost of goods sold is incorrect, ending inventory is usually incorrect too. B. Beginning inventory + purchases = cost of goods sold C. Ending inventory +...

-

The following molecule was founded by an intermolecular aldol reaction. What dicarbonyl precursor was used for itspreparation?

-

Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO. 1 Date...

-

A company may go through organizational change at various stages in its life cycle for a variety of reasons. Reasons can include a change in ownership as well as a change in the competitive...

-

6 (a) Below is a diagram of a rotating disc viscometer (FIGURE 4). Explain its operations and limitations as to use. If, in a similar works situation, it is necessary to make measurements on a...

-

As part of your role in the Business Analytics and Data Analytics team, you have been asked to forecast Food Retailing as part of a wider report being commissioned by the above collaboration - on...

-

You are three students who have together bought a business that makes snow. The customers consist of both large public enterprises and private individuals. The business is run all year round, but the...

-

Simplify the expression. Express the answer so that all exponents are positive. Whenever an exponent is 0 or negative, we assume that the base is not 0. (8x 3 ) 2

-

Review Exhibit 11.4. Analyze each product on the graph according to the characteristics that influence the rate of adoption. For example, what can you conclude from the data about the relative...

-

During 2017, Kent, a 40-year-old single taxpayer, reports the following items of income and expense: Income: Salary ..$150,000 Dividends from Alta Corporation .. 800 Interest income from a savings...

-

Sam owns a small apartment building (this is the only rental building Sam owns). During the year Sam incurs the following expenditures: Item Amount Replace roof and roof underlying structure because...

-

John Lucy makes wooden boxes in which to ship motorcycles. John and his three employees invest a total of 40 hours per day making 120 boxes. a) What is their productivity? b) John and his employees...

-

Roberson Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2018 fiscal year: Cost Retail Beginning inventory...

-

There are three basic approaches to CVP analysis - equation approach, contribution margin approach, and the contribution ratio margin approach. How are these approaches similar and how do they...

-

There are six farmers in Great Britain with access to government land to graze their cows for free. They all must share the land. Each farmer has an individual incentive to put as many of his cows on...

Study smarter with the SolutionInn App