Following are payroll deductions for Mars Co. Classify each payroll deduction as either a voluntary or involuntary

Question:

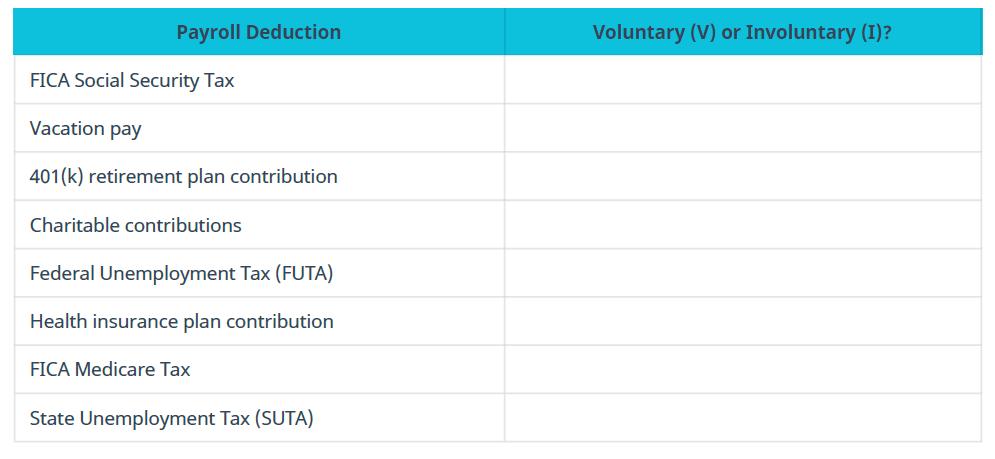

Following are payroll deductions for Mars Co. Classify each payroll deduction as either a voluntary or involuntary deduction. Record a (V) for voluntary and an (I) for involuntary.

Transcribed Image Text:

Payroll Deduction FICA Social Security Tax Vacation pay 401(k) retirement plan contribution Charitable contributions Federal Unemployment Tax (FUTA) Health insurance plan contribution FICA Medicare Tax State Unemployment Tax (SUTA) Voluntary (V) or Involuntary (I)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

A bankruptcy case may begin with either a voluntary or an involuntary petition. What is the difference? What are the requirements for an involuntary petition?

-

A bankruptcy case can begin with either a voluntary or an involuntary petition. What is the difference What are the requirements for an involuntary petition?

-

Classify each of the following voluntary settlements as an extension, a composition, or a combination of the two. a. Paying all creditors 30 cents on the dollar in exchange for complete discharge of...

-

Record your responses on the spreadsheet template. 2014 February 1 - Brady and Manning decide to start up a partnership. Brady brings in $10 000 cash and equipment costing $60 000, with $17 000 in...

-

Springs Corporation has developed a nature park at the site of Blue Springs. Because Newberry Corporation wants to develop several other springs in the area, Newberry wants to merge with Springs...

-

Look at Tables 4.1 and 4.2 together. What is the total surplus if Bob buys a unit from Carlos? If Barb buys a unit from Courtney? If Bob buys a unit from Chad? If you match up pairs of buyers and...

-

1. Describe types of control and tools for controlling.

-

Super Sales Company is the exclusive distributor for a high-quality knapsack. The product sells for $60 per unit and has a CM ratio of 40%. The companys fixed expenses are $360,000 per year. The...

-

Over the last year net PP&E for Hershey's has increased from 774 million dollars to 894 million dollars. You also notice that Hershey's reported a depreciation expense of 61 million dollars. What was...

-

The two particles of mass m and 2m, respectively, are connected by a rigid rod of negligible mass and slide with negligible friction in a circular path of radius r on the inside of the vertical...

-

Which of the following accounts are used when a short term note payable with 5% interest is honored (paid)? A. Short-term notes payable, cash B. Short-term notes payable, cash, interest expense C....

-

Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% annual interest rate and payable in 8...

-

Describe the following factorial design. How many independent and dependent variables are there? How many levels are there for each treatment? If the data were known, could interaction be determined...

-

Lucy is using a one-sample test based on a simple random sample of size = 24 to test the null hypothesis = 23.000 cm against the alternative hypothesis < 23.000 cm. The sample has mean 22.917 cm and...

-

A motorcyclist of mass 60 kg rides a bike of mass 40 kg. As she sets off from the lights, the forward force on the bike is 200N. Assuming the resultant force on the bike remains constant, calculate...

-

A load downward load P = 400 N is applied at B. It is supported by two truss members with member BA at an angle of 0 = 45 from horizontal and member BC at an 01 = angle of 02 25 from vertical....

-

Gross profit, defined as Net sales less Cost of products sold increased by $279 million in 2017 from 2016 and decreased by $2 million in 2016 from 2015. As a percent of sales, gross profit was 38.8%...

-

An electro-magnetic shield is to be made of galvanized steel with conductivity = 1.74 x 106 S/m, and magnetic permeability HR = 80. The thickness of cold rolled steel is in the following table. Gauge...

-

In a probability model, which of the following numbers could be the probability of an outcome? 3 1.5 2 4 3 4

-

Why is homeostasis defined as the "relative constancy of the internal environments? Does negative feedback or positive feedback tend to promote homeostasis?

-

In Problem 14, what is the cost of equity after recapitalization? What is the WACC? What are the implications for the firms capital structure decision? In problem 14 Cede & Co. expects its EBIT to be...

-

Levered, Inc., and Unlevered, Inc., are identical in every way except their capital structures. Each company expects to earn $275,000 before interest per year in perpetuity, with each company...

-

Tool Manufacturing has an expected EBIT of $48,700 in perpetuity and a tax rate of 35 percent. The firm has $90,000 in outstanding debt at an interest rate of 6.5 percent, and its unlevered cost of...

-

Product Weight Sales Additional Processing Costs P 300,000 lbs. $ 245,000 $ 200,000 Q 100,000 lbs. 30,000 -0- R 100,000 lbs. 175,000 100,000 If joint costs are allocated based on relative weight of...

-

The projected benefit obligation was $380 million at the beginning of the year. Service cost for the year was $21 million. At the end of the year, pension benefits paid by the trustee were $17...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

Study smarter with the SolutionInn App