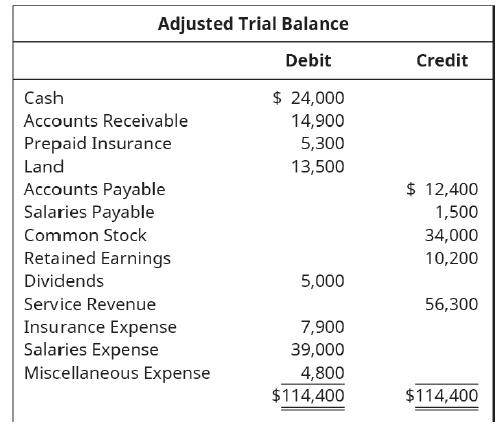

From the following Company T adjusted trial balance, prepare the following: A. Income Statement B. Retained Earnings

Question:

From the following Company T adjusted trial balance, prepare the following:

A. Income Statement

B. Retained Earnings Statement

C. Balance Sheet (simple—unclassified)

D. Closing journal entries

E. Post-Closing Trial Balance

Transcribed Image Text:

Adjusted Trial Balance Debit $ 24,000 14,900 5,300 13,500 Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Salaries Payable Common Stock Retained Earnings Dividends Service Revenue Insurance Expense Salaries Expense Miscellaneous Expense 5,000 7,900 39,000 4,800 $114,400 Credit $ 12,400 1,500 34,000 10,200 56,300 $114,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

A Income Statement An income statement shows a companys revenues and expenses over a specific period of time It is used to determine the companys net ...View the full answer

Answered By

BillClinton Muguai

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

From the following Company B adjusted trial balance, prepare simple financial statements, as follows: A. Income Statement B. Retained Earnings Statement C. Balance Sheet Adjusted Trial Balance Debit...

-

From the following Company Y adjusted trial balance, prepare simple financial statements, as follows: A. Income Statement B. Retained Earnings Statement C. Balance Sheet Adjusted Trial Balance Debit...

-

From the following Company Z adjusted trial balance, prepare simple financial statements, as follows: A. Income Statement B. Retained Earnings Statement C. Balance Sheet Adjusted Trial Balance Debit...

-

According to Dr. Grant, creatives are people who ________. A. Are procrastinators B. Act on multiple ideas C. Plan out each detail D. Are highly confident with no doubts about their success

-

What has happened to the number of people on welfare since 1994? What explains the change over time?

-

Defend the benefits of the Delphi Method, and suggest two to three situations in which your past or current employer should have used it. Provide specific examples to support your rationale.

-

Complete the following input/output report. What are the planned and actual backlogs at the end of period 4? LO.1

-

CH3CH2SH + CH3O- A (contains sulfur) + B C + H2O D + E (which is inorganic) (a) Given the above sequence of reactions, draw structures for A through E. (b) Rewrite the reaction sequence, showing all...

-

Order for 1,000 tables. Assume direct labor costs per hour or $20. Activity Order, Units Direct Materials 1,000 112,800 Machine Hours 15,100 Direct Labor Hours 5,200 70 Number of Purchase Orders...

-

Greenville has provided the following information from its General Fund Revenues and Appropriations/ Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund...

-

If current assets are $100,000 and current liabilities are $42,000, what is the working capital? A. 200 percent B. 50 percent C. 2.0 D. $58,000

-

From the following Company S adjusted trial balance, prepare the following: A. Income Statement B. Retained Earnings Statement C. Balance Sheet (simpleunclassified) D. Closing journal entries E....

-

Suppose you created a two-stock portfolio by investing $50,000 in Alta Industries and $50,000 in Repo Men. (1) Calculate the expected return (rp), the standard deviation (Ïp), and the...

-

What is the difference between corporate and clinical? How do they differ? Can they both have the same outcome? Include a reference list that supports your stance of no fewer than 3 scholarly...

-

How do we attain the desire for the freedom to purse one's passions, the desire for economic security and well-being, the desire for hope and progress in one's life utilizing higher-order thinking

-

Instructions FNCE 625 - Investment Analysis and Management Group Project - Case Study Guideline Introduction: In this group assignment, each team will collaboratively make a comprehensive report and...

-

21) The EOQ model is solved using calculus but the key intuition is that relevant total costs are minimized when relevant ordering costs equal relevant carrying costs. 22) Safety stock is used as a...

-

In the long-term, what do you recommend as overall policy in order to reduce or avoid the kinds of PPE shortages that occurred during the different waves of the COVID virus? In simple terms, how...

-

Evaluate the following integrals two ways. a. Simplify the integrand first and then integrate. b. Change variables (let u = ln x), integrate, and then simplify your answer. Verify that both methods...

-

How does the organizational structure of an MNC influence its strategy implementation?

-

In no more than three PowerPoint slides, list some general guidelines that a taxpayer can use to determine whether it has an obligation to file an income tax return with a particular state. (Include...

-

Fallow Corporation is subject to tax only in State X. Fallow generated the following income and deductions. State income taxes are not deductible for X income tax purposes. Sales...

-

Dillman Corporation has nexus in States A and B. Dillmans activities for the year are summarized below. Determine the apportionment factors for A and B assuming that A uses a three-factor...

-

This is a partial adjusted trial batance of Cullumber Compary manualys

-

Which of the following journal entries will record the payment of a $1,500 salaries payable originally incurred for Salaries Expense? Select one: A. Debit Salaries Expense; credit Salaries Payable B....

-

What is the definition of substantially appreciated inventory? A. Inventory with a FMV greater than its basis B. Inventory and unrealized receivables with a FMV greater than their basis C. Inventory...

Study smarter with the SolutionInn App