Mountain Peaks applies overhead on the basis of machine hours and reports the following information: A. What

Question:

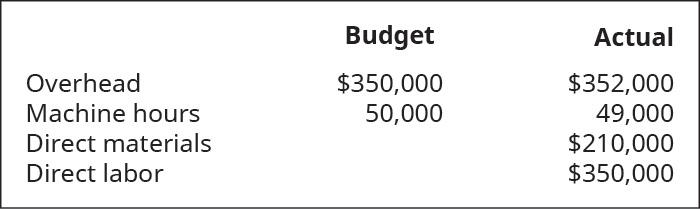

Mountain Peaks applies overhead on the basis of machine hours and reports the following information:

A. What is the predetermined overhead rate?

B. How much overhead was applied during the year?

C. Was overhead over- or underapplied, and by what amount?

D. What is the journal entry to dispose of the over- or underapplied overhead?

Transcribed Image Text:

Overhead Machine hours Direct materials Direct labor Budget $350,000 50,000 Actual $352,000 49,000 $210,000 $350,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

A To calculate the predetermined overhead rate we divide the budgeted overhead by the budgeted machi...View the full answer

Answered By

Ma Kristhia Mae Fuerte

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted:

Students also viewed these Business questions

-

The Towson Manufacturing Corporation applies overhead on the basis of machine hours. The following divisional information is presented for your review: Find the unknowns for each of thedivisions....

-

Mountain Tops applies overhead on the basis of direct labor hours and reports the following information: A. What is the predetermined overhead rate? B. How much overhead was applied during the year?...

-

Opticom, Inc. a manufacturer of fiber optic communications equipment, uses a j ob-order costing system. Since the production process is heavily automated, manufacturing overhead is applied on the...

-

Steel It began January with 55 units of iron inventory that cost $35 each. During January, the company completed the following inventory transactions: Requirements 1. Prepare a perpetual inventory...

-

Prince Clark Winery requested that you determine whether the companys ability to pay its current liabilities and long-term debts improved or deteriorated during 2012. To answer this question, compute...

-

Sue died on May 3, 2022. On October 1, 2018, Sue gave her son Tom land valued at $17,015,000. Sue applied a unified credit of $4,417,800 against the gift tax due on this transfer. On Sues date of...

-

What are the relevant costs to be considered when deciding whether to take a quantity discount? On what basis should the decision be made? LO.1

-

Authors Academic Publishing faces three potential contingency situations, described below. Authors fiscal year ends December 31, 2015. Required: Determine the appropriate means of reporting each...

-

An investment earns 10% compounded continuously. What amount should be invested now to have $9000 in 6 years. Round to the nearest cent. $

-

A new company started production. Job 1 was completed, and Job 2 remains in production. Here is the information from the job cost sheets from their first and only jobs so far: Using the information...

-

From beginning to end, place these items in the order of the flow of goods. A. Cost of goods sold B. Raw materials inventory C. Finished goods inventory D. Work in process inventory

-

What is a contract? What form can a contract take?

-

Show how you would go about balancing the following equations: Cu + HNO3 Cu(NO3)2 + NO + H2O HIO3 + Fel2 + HCI FeCl3 + ICI + H2O 2.Conservation of mass A student places 0.58 g of iron and 1.600 g...

-

Sales MOSS COMPANY Income Statement For Year Ended December 31, 2021 Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes...

-

Prior to the Covid-19 epidemic, Master's and Ph.D. programs in psychology required applying students to submit their scores on the standardized graduate admission exam (GRE). For the past three...

-

Benicio wants to make sure that the Sales table does not contain any duplicate records, which would make any sales analysis incorrect. Identify and remove duplicate records in the Sales table as...

-

University Car Wash purchased new soap dispensing equipment that cost $261,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car...

-

Bandolero Corporation has developed ideal standards for four activities: labor, materials, inspection, and receiving. Information is as follows: The actual prices paid per unit of each activity...

-

SBS Company have received a contract to supply its product to a Health Care Service Hospital. The sales involve supplying 1,250 units every quarter, the sales price is RM 85 per unit. The Client...

-

Discuss the importance of a company having proper insurance and bonding its employees.

-

There are three employees in the accounting department: payroll clerk, accounts payable clerk, and accounts receivable clerk. Which one of these employees should not make the daily deposit? A....

-

Which of the following transactions will require a journal entry? Indicate if it will be a debit or a credit, and to which account the entry will be recorded. Transaction Overcharge by Bank (Error)...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App