Prepare journal entries for the following transactions of Maritime Memories. May 2 May 6 May 16 May

Question:

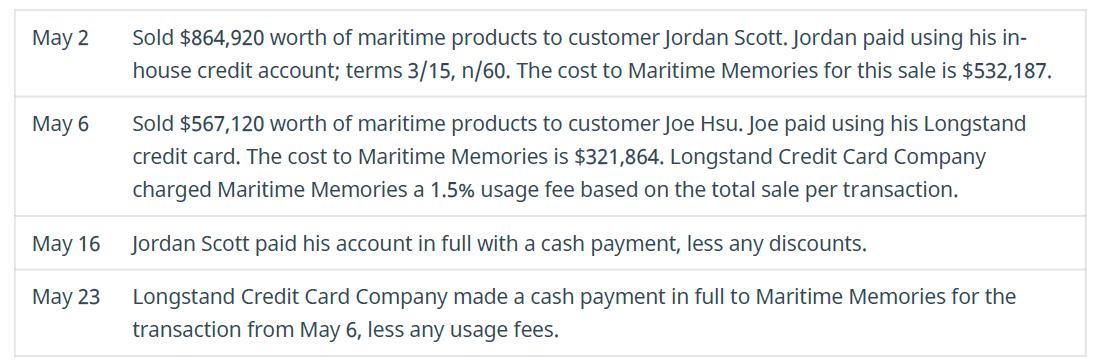

Prepare journal entries for the following transactions of Maritime Memories.

Transcribed Image Text:

May 2 May 6 May 16 May 23 Sold $864,920 worth of maritime products to customer Jordan Scott. Jordan paid using his in- house credit account; terms 3/15, n/60. The cost to Maritime Memories for this sale is $532,187. Sold $567,120 worth of maritime products to customer Joe Hsu. Joe paid using his Longstand credit card. The cost to Maritime Memories is $321,864. Longstand Credit Card Company charged Maritime Memories a 1.5% usage fee based on the total sale per transaction. Jordan Scott paid his account in full with a cash payment, less any discounts. Longstand Credit Card Company made a cash payment in full to Maritime Memories for the transaction from May 6, less any usage fees.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (15 reviews)

Step 1 To determine Concept Introduction A journal is a book of original entry in which the financia...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Prepare journal entries for the following transactions that occurred during July: 201X July 1 Jodi Wills invested $90,000 cash and $11,000 of equipment into her new business. 3 Purchased building for...

-

Prepare journal entries for the following transactions that occurred during March: 201X Mar. 1 Jordan Doxbury invested $50,000 cash and $5,000 of equipment into her new business. 3 Purchased building...

-

Prepare journal entries for the following transactions that occurred during 2014: May 1 Purchased equipment on account; $500. 2 Paid for the equipment purchased on May 1. 3 Purchased supplies for...

-

Sally works as a welder at Heavy Iron Works Company. She is the only female welder in a shop with ten male welders. Teddy is the manager of that shop with Sally and the ten male welders. Sally is...

-

What factors determine a central bank's independence? What are the benefits of having an independent central bank?

-

The sum of the squares of two consecutive even integers, the first of which is 2n Write an algebraic expression for the verbal description.

-

.31 No Bans/No Others 55

-

Alubar, a U.S. multinational, receives royalties from Country A, foreign-branch earnings from Country B, and dividends equal to 50 percent of net income from subsidiaries in Countries C and D. There...

-

In the space below, you are to prepare in proper format: an income statement for Harvest Inc. for the year ended December 31, 2021 (17 marks) a statement of changes in equity for Harvest Inc. for the...

-

For Youth Agency (FYA) is a voluntary health and welfare organization that provides counseling and recreation programs for youthful offenders and delinquents. FYAs programs are financed through a...

-

Prepare journal entries for the following transactions from Angled Pictures. June 21 June 30 Customer LeShaun Rogers purchased 167 picture frames at a sales price of $28 per frame with her American...

-

Prepare journal entries for the following transactions of Dulce Delights. Apr. 10 Apr. 13 Apr. 20 Apr. 25 Sold 320 ice cream buckets with a sales price of $12 per bucket to customer Livia Diaz. Livia...

-

Use the Fundamental Theorem to evaluate the definite integral exactly. -3 [e f dt

-

BREAD Products' pretax income for 2019 is * (1 Point) BREAD Products has no Work in Process or Finished Goods inventories at the close of business on December 31, 2018. The balances of BREAD's...

-

Convert the following line of code into assembly language. A (A B)+(BA) Where A and B are both 8-bit variables Activate Windows

-

14. Create a one variable Data Table from what you just copied and pasted giving the total sales for each department, and the Largest Sale from each department. Start your Criteria range in cell A1....

-

E4.1 (LO 1), C The following independent situations require professional judgment for determining when to recognize revenue from the transactions. a. Southwest Airlines sells you an advance-purchase...

-

Spring Flings Company, a fashion retailer that specializes in colorful graphic tees, prepares a master budget on a quarterly basis. The company has assembled the following data to assist in preparing...

-

Tell whether the expression is a polynomial. If it is, give its degree. If it is not, state why not. 3x 2 5

-

Clark, PA, has been engaged to perform the audit of Kent Ltd.s financial statements for the current year. Clark is about to commence auditing Kents employee pension expense. Her preliminary enquiries...

-

Indicate which of the following taxes are generally progressive, proportional, or regressive: a. State income taxes b. Federal estate tax c. Corporate state franchise tax d. Property taxes e. State...

-

Carolyn operates a consulting business as a sole proprietor (unincorporated). Carolyn has been approached by one of her major clients to become an employee. If she accepts the new job, she would no...

-

During 2017, Julio attended school for much of the year but was supported by his parents. Julio married Jillian in December 2017. Julio graduated and began working full-time in 2018. Jillian worked...

-

A family has a $117,443, 25-year mortgage at 5.4% compounded monthly. (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $100 to its mortgage...

-

Comparing the actual and planned cost of a consulting engagement completed by an engineering firm such as Allied Engineering.

-

What is the NPV of a project that costs $34,000 today and is expected to generate annual cash inflows of $11,000 for the next 7 years, followed by a final inflow of $14,000 in year 8. Cost of capital...

Study smarter with the SolutionInn App