Prepare the assets section of the balance sheet as of December 31 for Hoopers International using the

Question:

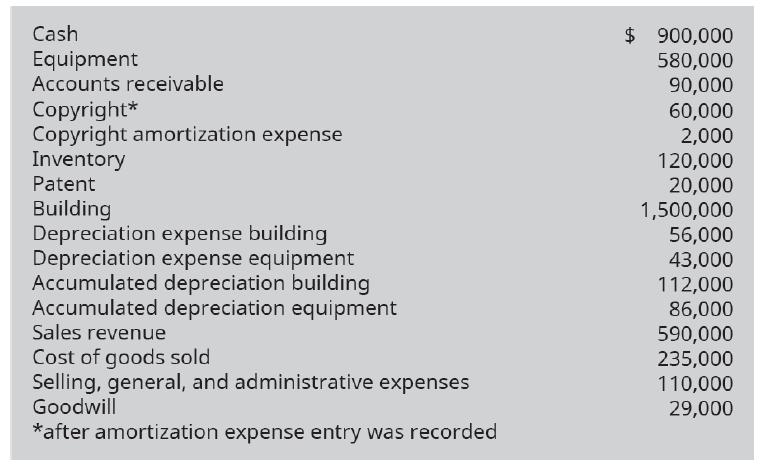

Prepare the assets section of the balance sheet as of December 31 for Hooper’s International using the following information:

Transcribed Image Text:

Cash Equipment Accounts receivable Copyright* Copyright amortization expense Inventory Patent Building Depreciation expense building Depreciation expense equipment Accumulated depreciation building Accumulated depreciation equipment Sales revenue Cost of goods sold Selling, general, and administrative expenses Goodwill *after amortization expense entry was recorded $ 900,000 580,000 90,000 60,000 2,000 120,000 20,000 1,500,000 56,000 43,000 112,000 86,000 590,000 235,000 110,000 29,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (7 reviews)

Hoopers International Balance sheet At December 31 Current assets Cash 900000 Account...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

Prepare the current assets section of the balance sheet as of May 31, 2012, for Nancys Spices and More, Inc., using the following information: Accounts...

-

Prepare the current assets section of the balance sheet as of December 31, 2013, for Lipton, Inc. using the following information: Accounts Receivable ......$63,000 Petty Cash ......... 500 Cash in...

-

Prepare the current assets section of the balance sheet as of May 31, 2016, for Spices and More, Inc., using the following information: Account Receivable...

-

Rachael Ray Corporation had the following transactions. 1. Sold land (cost $12,000) for $15,000. 2. Issued common stock for $20,000. 3. Recorded depreciation of $17,000. 4. Paid salaries of $9,000....

-

Explain why a good or service that is offered at a monetary price of zero is unlikely to be a truly "free" good from an economic perspective.

-

Alan Forsythe, a middle-aged college professor from Boston, is in the Swiss Alps studying astronomy during his sabbatical leave. He has been there for two days and plans to stay the entire year....

-

Examining the Monty Hall Dilemma. In Exercise 3.133 (p. 214), you solved the game show problem of whether or not to switch your choice of three doorsone of which hides a prizeafter the host reveals...

-

Summary operating data for Eco-Windows Company during the current year ended June 30, 20Y6, are as follows: cost of merchandise sold, $3,800,000; administrative expenses, $1,200,000; interest...

-

The value of a firm is equal to the sum of all future nominal profits that will be generated by the firm. O A True OB. False OC NA OD NA

-

Rhonda, a CPA and a member, has just signed an engagement letter with Beachboy Fashions, Inc. to provide monthly bookkeeping and complied financial for the company beginning in the year 20x5. In...

-

Akira Company had the following transactions for the month. Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that...

-

For each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a ten-year remaining legal life was...

-

Identify an industry that would employ a system of batch costing.

-

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob ODonnell, a local merchant, to contribute the capital to form a partnership....

-

One of the main purposes of evaluation research is: a. reexamining previously collected data. b. monitoring and improving programs. c. generating rich descriptions of individual perspectives. d....

-

10.13 Sweetlip Ltd and Warehou Ltd are two family-owned flax-producing companies in New Zealand. Sweetlip Ltd is owned by the Wood family and the Bradbury family owns Warehou Ltd. The Wood family has...

-

distribution that is skewed to the right instead of being normally distributed. Assume that we collect a random sample of annual incomes of 50 statistics students. Can the distribution of incomes in...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

Use the accompanying graph of y = f(x). Does exist? If it does, what is it? lim f(x) 4 (-2, 2) (-6, 2) (-4, 1) -6 -4 -2 4 -2 -4

-

Find the radius of convergence of? 1.2.3 1.3.5 (2n-1) r2n+1 -1

-

Private Corporation redeems some of its stock from Jane, a major shareholder. Before the redemption Jane owns 50 of the 100 outstanding shares, and her daughter Jill owns 40 shares. The remaining ten...

-

Prime Corporation redeems some of its stock from two of its shareholders on the same date. Frank and his son Sam own 50 and 20 shares, respectively, of the 100 shares outstanding before the...

-

Queen Corporation adopts a plan of complete liquidation on January 1 of the current year. The corporation sells the assets listed below to King Corporation during the current year. This sale is...

-

Product Weight Sales Additional Processing Costs P 300,000 lbs. $ 245,000 $ 200,000 Q 100,000 lbs. 30,000 -0- R 100,000 lbs. 175,000 100,000 If joint costs are allocated based on relative weight of...

-

The projected benefit obligation was $380 million at the beginning of the year. Service cost for the year was $21 million. At the end of the year, pension benefits paid by the trustee were $17...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

Study smarter with the SolutionInn App