Remarkable Enterprises requires four units of part A for every unit of A1 that it produces. Currently,

Question:

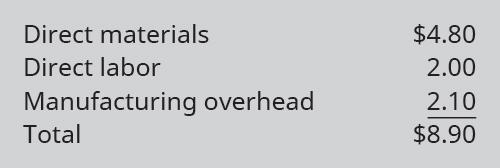

Remarkable Enterprises requires four units of part A for every unit of A1 that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced:

Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next year’s production.

Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted: