Trini Company had the following transactions for the month. Calculate the cost of goods sold dollar value

Question:

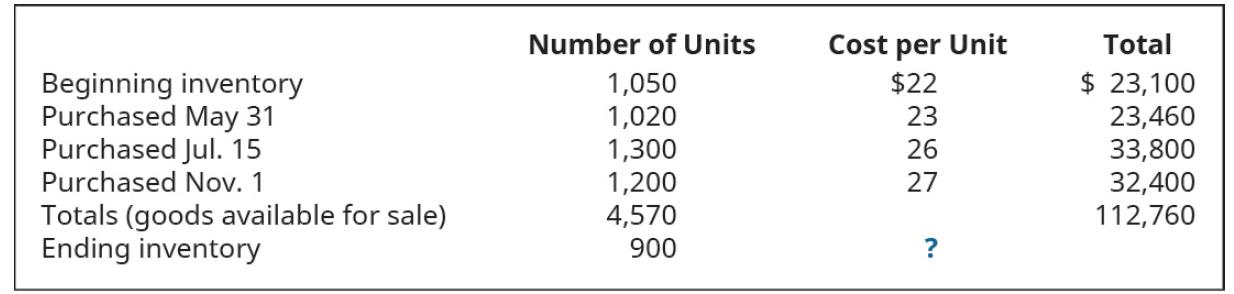

Trini Company had the following transactions for the month.

Calculate the cost of goods sold dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations.

A. First-in, first-out (FIFO)

B. Last-in, first-out (LIFO)

C. Weighted average (AVG)

Transcribed Image Text:

Beginning inventory Purchased May 31 Purchased Jul. 15 Purchased Nov. 1 Totals (goods available for sale) Ending inventory Number of Units 1,050 1,020 1,300 1,200 4,570 900 Cost per Unit $22 3825 26 27 ? Total $ 23,100 23,460 33,800 32,400 112,760

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

1 24300 under FIFO method the units taken for the sale is the oldest purchasethat is first purchase ...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

In 2014, Kadlec Company had the following transactions related to the purchase of a property. All transactions were for cash unless otherwise stated. Jan. 12 Purchased real estate for a future plant...

-

In 2014, Weisman Company had the following transactions related to the purchase of a property. All transactions are for cash unless otherwise stated. Feb. 7 Purchased real estate for $575,000, paying...

-

The Picture Perfect Camera Shop had the following transactions for the month of August 2016. Aug. 1, Purchased cameras for $4,100 plus a freight charge of $220 from the Mason Company, Invoice 532,...

-

Draw isometric projection of the following figure 10 40 50 $30 Pg. 3 : 20

-

Why is vaccination against many childhood illnesses a legal requirement for entry into public schools?

-

A fork from a forklift is constrained by two bars (not shown) that fit into each L-shaped appendage on the vertical part of the fork as shown in Figure P11-21. The fork is made of AISI 4130 steel...

-

Shared leadership in airplane crews. Human Factors (March 2014) published a study that examined the effect of shared leadership by the cockpit and cabin crews of a commercial airplane. Simulated...

-

At the end of its fiscal year, the trial balance for Andy's Cleaners appear as shown below: The following information is also available: a. A study of the company's insurance policies shows that $680...

-

A 30-year maturity, 8% coupon bond paying coupons semiannually is callable in five years at a call premium of 9%. The bond currently sells at a yield to maturity of 5%. What is the yield to call?

-

Explain why correctly owning assets is important to the personal finances of people, especially couples.

-

DeForest Company had the following transactions for the month. Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory...

-

The legal protection that provides a company exclusive rights to produce and sell a unique product is known as which of the following? A. Trademark B. Copyright C. Patent D. Goodwill

-

What is representational neglect?

-

1.A woman eats 65g of protein per day. She weighs 156 lbs. How much protein is she getting per kg of body weight? Explain briefly both question 2.152 lbs = ________________kg. [2.2 lbs = 1 kg] explain

-

The concrete slab shown in Figure is 7m x 5m. The slab is not supported along one of the 7m long edges (free edge). The other three edges are supported and continuous over the supports, and therefore...

-

1. If possible, find 4-B -[{3}][{3}] A=

-

Georgi owns 50% of Forbes, Inc., an S corporation. At the beginning of the current tax year, Georgi had zero basis and an unused net business loss carryover of $10,000. During the tax year, she...

-

luation, of Fundamental Managerial Accounting Concepts. Use Excelshowing all work and formulasto complete the following: Prepare a flexible budget. Compute the sales volume variance and the...

-

Evaluate the expression if x = -2 and y = 2. 2

-

What mass of H2 will be produced when 122 g of Zn are reacted? Zn(s) + 2HCl(aq) ( ZnCl2(aq) + H2(g)

-

At the close of business on May 31, 2017, Alaska Corporation exchanges $2 million of its voting common stock for all the noncash assets of Tennessee Corporation. Tennessee uses its cash to pay off...

-

Ruby Corporation has 100 shares of common stock outstanding. Fred, a shareholder of Ruby, exchanges his 25% interest in the Ruby stock for Garnet Corporation stock and securities. Ruby purchased 80%...

-

Murray Corporations stock is owned by about 1,000 shareholders, none of whom own more than 1% of the outstanding shares. Pursuant to a tender offer, Said purchased all the Murray stock for $7.5...

-

Al preparar el estado de resultados pro forma, cules de las siguientes partidas se deducen de las utilidades brutas para llegar a las ganancias despus de impuestos? Pregunta de seleccin mltiple....

-

Lawson Inc. is expanding its manufacturing plant, which requires an investment of $4 million in new equipment and plant modifications. Lawson's sales are expected to increase by $3 million per year...

-

20 On January 1, Year 1, X Company purchased equipment for $80,000. The company estimates that the equipment will have a useful life of 10 years and a residual value of $5,000. X Company depreciates...

Study smarter with the SolutionInn App