Use the following Adjusted Trial Balance to prepare a classified Balance Sheet: Adjusted Trial Balance Debit $17,000

Question:

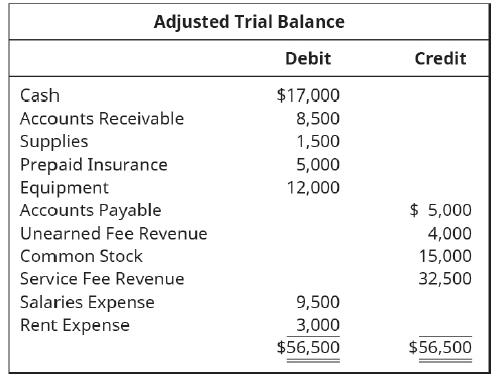

Use the following Adjusted Trial Balance to prepare a classified Balance Sheet:

Transcribed Image Text:

Adjusted Trial Balance Debit $17,000 8,500 1,500 5,000 12,000 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Unearned Fee Revenue Common Stock Service Fee Revenue Salaries Expense Rent Expense 9,500 3,000 $56,500 Credit $ 5,000 4,000 15,000 32,500 $56,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Classified Balance Sheet Assets Current Assets Cash 17000 A...View the full answer

Answered By

Rodrigo Louie Rey

I started tutoring in college and have been doing it for about eight years now. I enjoy it because I love to help others learn and expand their understanding of the world. I thoroughly enjoy the "ah-ha" moments that my students have. Interests I enjoy hiking, kayaking, and spending time with my family and friends. Ideal Study Location I prefer to tutor in a quiet place so that my students can focus on what they are learning.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Use the following Adjusted Trial Balance to prepare a classified Balance Sheet: Adjusted Trial Balance Debit $16,500 17,200 2,200 2,100 14,000 Cash Accounts Receivable Supplies Prepaid Insurance...

-

Use the following adjusted trial balance of Hanson Trucking Company to prepare a classified balance sheet as of December 31, 2014. Account Title Debit Credit S 13,000 29,600 3,100 170,000 Cash...

-

Use the following adjusted trial balance information for JetCo's December 31, 2014, year-end to prepare (a) A classified multi-step income statement. (b) A single-step income statement. Account Debit...

-

Differentiate f(x) = log 10 (2 + sin x).

-

In a single-issue majority vote, such as the TV example in this chapter, does the median voter always get his or her most preferred outcome?

-

George bought the following amounts of Stock A over the years: On October 12, 2015, he sold 1,200 of his shares of Stock A for $38 per share. a) How much gain/loss will George have to recognize if he...

-

Distinguish between financial and scoring models. AppendixLO1

-

The density and specific heat of a plastic material are known (p = 950 kg/m 3 , c p = 1100 J/kg K), but its thermal conductivity is unknown. To determine the thermal conductivity, an experiment is...

-

2020 (Marks: 10) Question 7 Plane CC was registered on 1 August 2015. The founding statement of the Close Corporation (CC) sets out the following: The nature of the business - a spare parts retailer...

-

Suppose there are three types of individuals: high productivity (HP), medium productivity (MP) and low productivity (LP). LP and MP workers amount for a proportion of sizes qL and qM of the entire...

-

Which of these accounts is not included in the post-closing trial balance? A. Land B. Notes Payable C. Retained Earnings D. Dividends

-

Using the following Balance Sheet summary information, calculate for the two years presented: A. Working capital B. Current ratio Current assets Current liabilities 12/31/2018 $366,500 120,000...

-

Search for examples of branded emoji campaigns (note that emojis associated with these campaigns may vanish after a period of time). What do you think of these campaigns? Have you or friends...

-

On Apple company with specific iPhone product Required to conduct a SWOT and PESTEL analysis, identifying the internal strengths and weaknesses and external opportunities and threats of the Apple...

-

In which social platforms are Walmart's brand/company active? In your opinion, are they doing a good job regarding customer engagement through social media channels? (Required: screenshots from the...

-

After you have watched both films, how would you describe each film? Also, consider what makes these early films different. List as many observations as you can that separate the Lumi re brothers...

-

How to develop the following points with the Poshmark application for second hand? 1. What are the main reasons for using this product? Or why not? 2. What are the hidden motivations? 3. Are there...

-

Suppose, in an experiment to determine the amount of sodium hypochlorite in bleach, you titrated a 22.84 mL sample of 0.0100 M K I O 3 with a solution of N a 2 S 2 O 3 of unknown concentration. The...

-

Derive the following derivative formulas given that d/dx(cosh x) = sinh x and d/dx(sinh x) = cosh x. d/dx(sech x) = -sech x tanh x

-

On January 2, 20X3, Sheldon Bass, a professional engineer, moved from Calgary to Edmonton to commence employment with Acco Ltd., a large public corporation. Because of his new employment contract,...

-

Drawing on data in Exhibit 3-4, do you think that Romania would be an attractive market for a firm that produces home appliances? What about Finland? Discuss your reasons.

-

Discuss the value of gross domestic product and gross national income per capita as measures of market potential in international consumer markets. Refer to specific data in your answer.

-

Discuss how the worldwide trend toward urbanization is affecting opportunities for international marketing.

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App