Use the following information relating to Medinas Company to calculate the inventory turnover ratio, gross margin, and

Question:

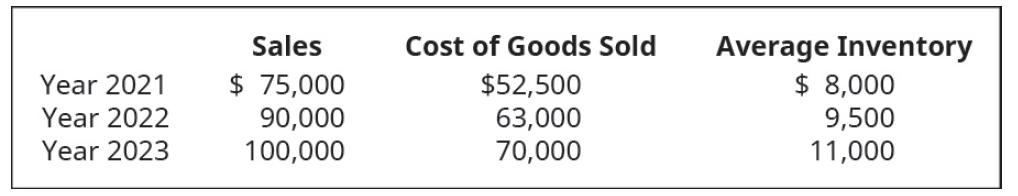

Use the following information relating to Medinas Company to calculate the inventory turnover ratio, gross margin, and the number of days’ sales in inventory ratio, for years 2022 and 2023.

Year 2021 Year 2022 Year 2023 Sales $ 75,000 90,000 100,000 Cost of Goods Sold $52,500 63,000 70,000 Average Inventory $ 8,000 9,500 11,000

Step by Step Answer:

Inventory Turnover Ratio Year 2022 Sales Average Invent...View the full answer

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

The Webster Store shows the following information relating to one of its products. Inventory, January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .250 units @ $17.00...

-

Use the following information relating to Clover Company to calculate the inventory turnover ratio, gross margin, and the number of days sales in inventory ratio, for years 2022 and 2023. Year 2021...

-

Use the following information relating to Singh Company to calculate the inventory turnover ratio and the number of days sales in inventory ratio. Year 2021 Year 2022 Year 2023 Year 2024 Sales...

-

Show that the angular wave number k for a non-relativistic free particle of mass m can be written as in which K is the particle's kineticenergy 27 V2mK k =

-

Consumers know that some fraction x of all new cars produced and sold in the market are defective. The defective ones cannot be identified except by those who own them. Cars do not depreciate with...

-

At shaw's Market, apples cost $10 per case and bananas cost $6 per case, if an order comes in for a total of 300 cases for $2,000, what was the specific number of cases of apples? A. 5 B. 15 C. 50 D....

-

3.9

-

Clark Company acquires an 80% interest in Hebron Company common stock for $400,000 cash on January 1, 2011. At that time, Hebron Company has the following balance sheet: Appraisals indicate that...

-

a. Use the appropriate formula to find the value of the annuity. b. Find the interest

-

Your client mr. Smith has requested a reservation at eleven madison park this evening for a party of 2 at 6pm. Unfortunately, the restaurant is fully committed. As an alternative, which restaurant...

-

Complete the missing pieces of Delgado Companys inventory calculations and ratios. Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Turnover ratio Days'...

-

Compute Altoona Companys (a) inventory turnover ratio and (b) number of days sales in inventory ratio, using the following information. Cost of goods sold Beginning inventory Ending inventory...

-

What are four reasons why accounts receivable confirmations may not provide reliable evidence?

-

Q13. The probability that Ryan will roll a three using a standard die is 1/6. Let Y = number of times that Ryan has to roll a die in order to roll the first three. What is the expected value for Y?...

-

1. The following are data for two IT projects for a new database system. Prepare a spreadsheet for two projects, using the following data. Amounts are in thousands of dollars. Calculate the NPV for...

-

The Matsui Lubricants plant uses the weighted-average method to account for its work-in-process inventories. The accounting records show the following information for a particular day: Beginning WIP...

-

James Cook, a production department worker, is paid on hourly basis at a rate of $15 per hour. James works 40 hours per week. Any time James works over 40 hours, it is considered as overtime and he...

-

You just started working as a Health Service Manager within one of the following healthcare industries. First, choose an industry below to discuss the questions that follow: Ambulatory Surgery center...

-

Write each statement as an inequality. x is less than 2

-

As indicated by mutual fund flows, investors tend to beat the market seek safety invest in last year's winner invest in last years loser

-

Luby Corporation acquires a 100% business-use automobile (MACRS 5-year recovery) on July 1, 2017 for $36,000. Luby does not elect Sec. 179 and elects out of bonus depreciation. What are depreciation...

-

Tracy acquires an automobile (MACRS 5-year recovery) on March 1, 2017. He uses the automobile 70% of the time in his business and 30% of the time for personal use. The automobile cost $36,000. No...

-

Troy entered into a three-year lease of a luxury automobile on January 1, 2017, for use 80% in business and 20% for personal use. The FMV of the automobile at the inception of the lease was $40,500,...

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

-

NEED THIS EXCEL TABLE ASAP PLEASE!!!! Presupuesto Operacional y C lculo del COGS Ventas Proyectadas: Ventas Proyectadas: $ 4 5 0 , 0 0 0 Precio por unidad: $ 4 5 0 Unidades vendidas: 4 5 0 , 0 0 0 4...

-

The wash sale rules apply to disallow a loss on a sale of securities_______? Only when the taxpayer acquires substantially identical securities within 30 days before the sale Only when the taxpayer...

Study smarter with the SolutionInn App