Brigitte Beckman is the senior in charge of the audit of Proctor Industries (PI), a public company

Question:

Brigitte Beckman is the senior in charge of the audit of Proctor Industries (PI), a public company in the business of wholesaling plumbing products. It is now November 3, 2001, five weeks after her client's year end, September 30, 2001, and one week before her firm, Evans & Martin, is required to discuss the auditor's report and financial statements with Pi's audit committee. Her firm is also required to report to the audit committee on all significant accounting and auditing issues encountered during the audit and on any recommendations for improving the internal control systems.

Pi's unconsolidated annual sales approximate \($36\) million. It operates through six regional branches with about equal sales volumes at each branch.

PI has a 60 percent interest in Minor Inc., a company located in the United Kingdom. Minor Inc. also has a September 30 year end and is audited by Schweitzer & Catts, Public Accountants.

Brigitte is at the client's premises reviewing the year-end working papers for Proctor Industries and notes the following items:

1. Pi's unconsolidated net income before taxes is normally about \($2\) million. Her firm employs a rotational audit approach on PI. Two branches are subject to a complete examination each year; the others are reviewed for unusual or significant fluctuations.

2. The confirmation of accounts receivable of the PI branches examined had disclosed \($18,000\) in double billings. The audit staff member determined that this occurred because several sales invoices at one branch were recorded twice near year end. The audit staff mem¬ ber has concluded that it is not significant because the error was isolated to one branch. Brigitte knows that sales from each branch are summarized in a weekly computerized report that is sent to head office to enable the general ledger to be updated.

3. The allowance for doubtful accounts in PI is \($200,000.\) Based on the work performed in this section of the audit, the audit staff member concluded that the allowance should be at least \($250,000\) and could be as high as \($300,000\).

4. Weekly cycle counts for inventory are performed at each branch, and the results are compared to the perpetual records. The perpetual records are used for year-end reporting purposes. The audit staff member assigned to the inventory section attended cycle counts in September at the two branches being examined. He checked a sample of quantities as counted by the PI cycle-counters and ensured that these quantities agreed to the perpetual records. They did in all but one case — one carton of 10 copper pipe fittings was incorrectly recorded in the perpetual records as containing 100 fittings. Pi's warehouse manager explained to the auditor that this error was probably an isolated incident due to human error. The perpetuals were adjusted to reflect the proper quantity and cost.

5. Brigitte has contacted Schweitzer & Catts to obtain the financial statements for Minor Inc. However, the firm is unable to provide her with audited financial statements since the president of Minor Inc. refuses to sign the management representation letter. He disagrees with the revenue recognition policy insisted on by Schweitzer & Catts and intends to obtain opinions from other audit firms on the issue. The financial statements, under the policy advocated by Schweitzer & Catts, show a net loss of \($320,000\) for the year.

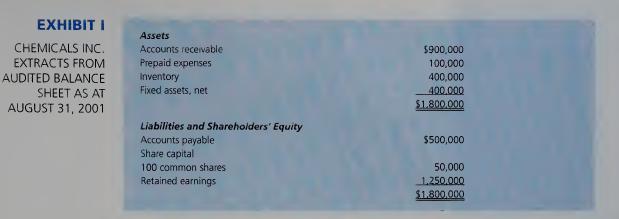

6. There is a new item on Pi's balance sheet called "Investments." The working papers show that this represents a cash payment in June 2001 of \($100,000\) for all of the common shares of Chemicals Inc. This company has always had an August 31 year end. Although Chemicals Inc. had previously never been audited, PI has requested, and Brigitte has completed, an audit of Chemicals Inc. for its August 31, 2001, year end. The audited balance sheet of Chemicals Inc. appears in Exhibit I. Chemicals Inc. manufactures household cleaning products. The equipment used in the manufacturing process is not complex and is inexpensive to replace. Chemicals Inc. has earned large profits in the past, mainly from government contracts. This year, the financial statements show an after-tax profit of \($100,000\).

7. An extract of the agreement to purchase Chemicals Inc. states that if the company earns more than \($1\) million per year in any of the next five years, the vendor may buy the common shares back for a price to be determined.

8. One of the legal letters for PI was returned with the following comment:

Chemicals Inc. may be liable for damages arising from the alleged dumping of hazardous chemicals from its Bedford plant into the nearby Black River. As of the current date, a statement of claim has been filed. Chemicals Inc. denies these allegations.

The partner has asked Brigitte to prepare a memo on the above-noted items for his use in discussions with the audit committee. Brigitte should also prepare notes for the audit staff regarding any follow-up work that she considers necessary as a result of her review.

Required Prepare the memo requested by the partner and the notes for the audit staff that Brigitte should write.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser