Medical Partnership (MP), a limited partnership, W was formed in July 2001 to permit the sale of

Question:

Medical Partnership (MP), a limited partnership, \W was formed in July 2001 to permit the sale of 10 partnership units at \($400,000\) per unit. The proceeds of \($4\) million together with a new first mortgage of \($8\) million are to be used to purchase four medical buildings that were con¬ structed about three years ago. At present (September 2001), these four buildings are fully leased to doctors, dentists, lab¬ oratory companies, a drugstore chain, and related medical services companies.

MP will be purchasing the four medical buildings effective October 1, 2001, from Hogg Investments Limited (HIL), a company owned by the promoters of MP. HIL was incorporated several years ago, when the idea of constructing the four medical buildings on land near a new hospital was first conceived, in order to handle all business matters. HIL was incorporated solely to hold the group of medical-building assets. HIL has arranged the new first mortgage of \($8\) million required to purchase the four buildings.

MP will operate with one general partner, Medic management Limited (ML), owned by HIL, and the 10 limited partners. ML will hold 0.01 percent of the ownership of MP but will have unlimited liability for MP's debts and obligations. The limited partners will be liable only to the extent of their equity contribution. The \($400,000\) minimum required investment exempts MP and its promoters from the requirements of provincial securities acts.

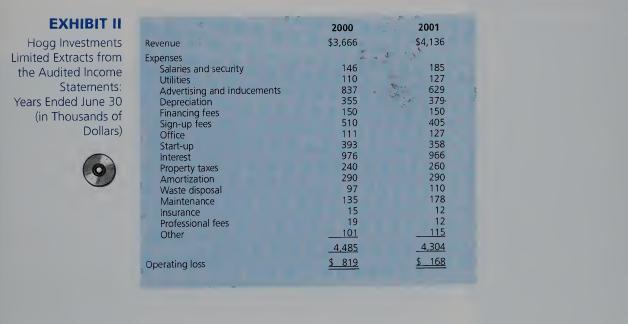

Since HIL's inception, its financial statements have always been audited by a firm of public accountants, which has issued unqualified auditor's reports each year. Income statements have been prepared for HIL for only the past two years because the company was previously in a startup stage.

In order to maintain the appearance of objectivity and independence, MP's promoters have decided to engage an independent accountant. They have recently approached your employer to assemble and report on the financial statements that they propose to include in a confidential sales document that is to be provided to prospective purchasers of an MP partnership unit. They would like the following in the document:

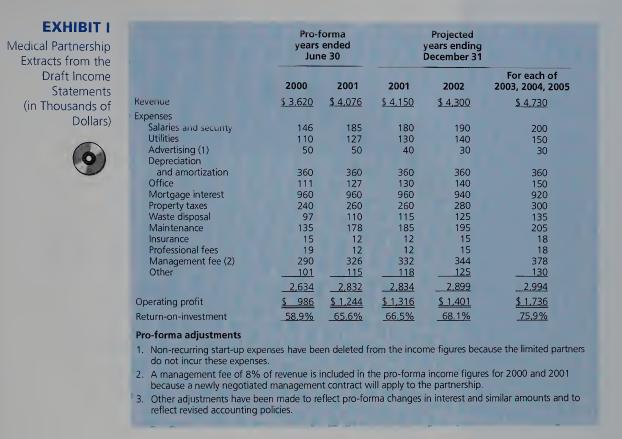

1. Pro-forma income statements for MP for each of the two years ended June 30, 2000 and 2001. These pro-forma statements would essentially be those of HIL, adjusted for pro-forma changes in interest expense, management fees and similar accounts, and changes in accounting policies. The promoters would like the income statements audited, preferably without a qualification. The auditors of HIL are willing to make their working papers available to you and to answer any questions.

2. Income statements and projected income statements of MP for each of the five years ended December 31, commencing with the year ended December 31, 2001.

You have been designated to prepare a report for the partner in charge of the proposed MP engagement. The partner wants your report to address the requests made by the promoters of MP. In addition, the partner wants to know what the major accounting and auditing issues are for this engagement.

You meet with the promoters of MP and the auditors of HIL, who provide you with the information listed below. The promoters also give you a draft copy of the income statement that they would like to see included in the confidential sales document (see Exhibit I). The auditors of HIL provide you with the audited income statement of that company for the 2001 and 2000 fiscal years (see Exhibit II).

1. The return-on-investment calculation in Exhibit I is based on net income plus (1) amortization, (2) interest on the mortgage, and (3) other noncash charges to arrive at a total that has been divided by the \($4\) million equity investment.

2. According to the promoters, adjustments have been made to Exhibit I on the assumption that a going concern will be sold to MP, whereas a startup operation is shown in Exhibit II. For example, expenses were incurred in paying for leasehold improvements and inducements to tenants. HIL has been writing them off over five years.

3. In Exhibit II, amortization has been recorded on a straight-line basis at an average rate of 5 percent a year on buildings and equipment.

4. The income statements in Exhibit I are based on recognizing revenue on an accrual basis, with no allowance for vacancies.

5. You have been provided with photographs of the four buildings.

6. An audit of the partnership's accounting records will occur if the units are sold by December 31, 2001.

7. The promoters expect your firm's income tax practitioners to assist with the marketing of the partnership units.

Required Prepare the requested report.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser