Miles Jones has been assigned as the audit senior responsible for a new client, Starfire Electric Limited

Question:

Miles Jones has been assigned as the audit senior responsible for a new client, Starfire Electric Limited (SEL). The engagement partner, Ms. Rogers, explained that SEL is a reputable private corporation located in Vancouver. It manufactures electrical components for residential and industrial uses. Major product lines include electrical fuses and circuit breakers for residential uses and heavy-duty breakers and transformers for industrial uses. During the current year, SEL also began producing electrical heating units for commercial applications.

SEL has been growing steadily over the past 10 years and has plants located in Vancouver, Calgary, and Winnipeg. It started with 10 employees and now employs over 200. Trans¬ formers are manufactured at the Vancouver plant, circuit breakers at the Calgary plant, and electrical fuses and heating units at the Winnipeg plant. In total, SEL produces about 600 products.

SEL has been experiencing some difficulty in obtaining supplies of plastics used as raw material in the production of circuit breakers. It is investigating the purchase of a plastics company located in the United States to ensure an adequate supply. SEL is considering a public offering after the year end to raise the estimated \($10\) million required to purchase this company.

Because SEL is considering a public offering, the directors decided that SEL should have its financial statements audited. A local chartered accounting firm had issued Notice to Readers for SEL since its incorporation. SEL looked for a larger accounting firm that could better serve its expanding operations and appointed your firm as auditors for the year ending September 30, 2001. Ms. Rogers has communicated with the previous accountants and has obtained an engagement letter from SEL.

Ms. Rogers asks you to prepare a planning memo for her review regarding the audit and accounting and other issues pertaining to this new assignment, along with your recommendations on how to deal with each of them.

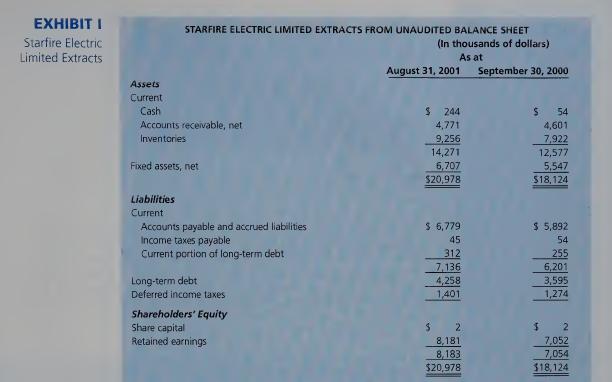

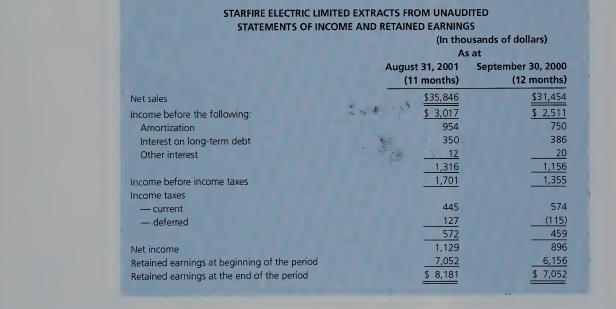

After your meeting with Ms. Rogers, you visit SEL's head office and obtain the most recent financial statements (see Exhibit I) and other information about the client's operations as shown:

• Each plant operates as a separate profit center, maintaining its own accounting system on a local area net¬ work. Each plant uses a copy of the head office programs. These programs are stored in object code (machine language) on the plant's server.

• Each plant is responsible for the control of its own computer operations, and each produces special-purpose reports for its own use using a general-purpose report writer as the need arises. The five accounting personnel at each location handle computer operations and the use of the report writer. File layouts are used to decide which data fields to access. Copies of new report for¬ mats are sent to head office as attachments to electronic mail messages when completed. Since these reports and new programs are produced as required, no formal testing procedures exist.

• Each plant also submits to head office a set of accounting reports and supplementary information. These are submitted in a standard format, electronically, for use in the preparation of combined corporate financial statements. The statements are prepared by the controller using a spreadsheet package.

• SEL's inventory consists of raw materials, work in progress, and finished goods. Raw materials include copper, used as a conductor in almost all of the components; silver, used for contacts in the electrical breakers; and plastic and steel, used in the casings for breakers and transformers. Most of the raw materials are pur¬ chased from suppliers in the United States.

• SEL uses a standard costing system to account for its inventory. A standard cost is prepared for each product by each plant based on its own production capacity, time and motion studies, and engineering estimates. Each standard cost consists of a raw material compo¬ nent, a direct labour component, and an overhead com¬ ponent that is based on direct labour hours. The costing and perpetual inventory systems were custom written by head office programmers.

• New standards are established once a year on April 1. The standard costs are entered in a standard cost mas¬ ter file and used to value inventories. Only two people at each plant have the password that allows them to change the standard cost master file. Password changes are controlled by the computer operators, who are informed orally of the need for change. The revaluation allowance resulting from the annual conversion of March 31 inventories to the new standard is amortized over the inventory turnover period. Normally, sales prices are updated at the same time by the sales super¬ visor using a separate password.

• The Vancouver plant's standard cost master file had been inadvertently changed during the performance of some computer program maintenance. The programs had been transmitted to the plant server from the head office systems by the head office's programming department. The head office programmers are attempt¬ ing to determine the cause of the data changes to ensure that the problem does not recur. As a result of the inadvertent change, the books in Vancouver had been showing favourable variances in the direct labour and overhead components of \($50,000\) and \($100,000\) respectively. As of August 31, \($60,000\) of these vari¬ ances has been allocated to cost of sales.

• The company Web page is maintained by head office personnel, with information on all of the different types of products and services. Since the Web page provides information only (customers cannot place orders), it is located directly on the head office server. Customers can view product information and send E-mail queries to anyone at the company using the Web page.

Required Prepare the memo requested by the partner.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser