Select the best answer for each of the following and give reasons for your choice: a. Which

Question:

Select the best answer for each of the following and give reasons for your choice:

a. Which of the following is the best way for the auditors to determine that every name on a company's payroll is that of a bona fide employee presently on the job?

(1) Examine human resources records for accuracy and completeness.

(2) Examine employees' names listed on payroll tax returns for agreement with payroll accounting records.

(3) Make a surprise observation of the company's regular distribution of paychecks on a test basis.

(4) Visit the working areas and verify that employees exist by examining their badge or identification numbers.

b. As a result of analytical procedures, the independent auditors determine that the gross profit percentage has declined from 30 percent in the preceding year to 20 percent in the current year. The auditors should:

(1) Express an opinion that is qualified due to the inability of the client company to continue as a going concern.

(2) Evaluate management's performance in causing this decline.

(3) Require note disclosure.

(4) Consider the possibility of a misstatement in the financial statements.

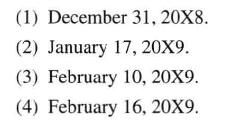

c. An auditor accepted an engagement to audit the \(20 \mathrm{X} 8\) financial statements of EFG Corporation and began the fieldwork on September 30, 20X8. EFG gave the auditor the 20X8 financial statements on January 17, 20X9. The auditor completed the fieldwork on February 10, 20X9, and delivered the report on February 16, 20X9. The client's representation letter normally would be dated:

d. Which of the following procedures is most likely to be included in the final review stage of an audit?

(1) Obtain an understanding of internal control.

(2) Confirmation of receivables.

(3) Observation of inventory.

(4) Perform analytical procedures.

e. Subsequent to the issuance of the auditor's report, the auditor became aware of facts existing at the report date that would have affected the report had the auditor then been aware of such facts. After determining that the information is reliable, the auditor should next:

(1) Notify the board of directors that the auditor's report must no longer be associated with the financial statements.

(2) Determine whether there are persons relying or likely to rely on the financial statements who would attach importance to the information.

(3) Request that management disclose the effects of the newly discovered information by adding a footnote to subsequently issued financial statements.

(4) Issue revised pro forma financial statements taking into consideration the newly discovered information.

f. Which of the following events occurring on January 5, 20X2, is most likely to result in an adjusting entry to the \(20 \mathrm{X} 1\) financial statements?

(1) A business combination.

(2) Early retirement of bonds payable.

(3) Settlement of litigation.

(4) Plant closure due to a strike.

Step by Step Answer:

Principles Of Auditing And Other Assurance Services

ISBN: 9780072327267

13th Edition

Authors: Ray Whittington, Kurt Pany